Between 1981 and 1982, the United States was going through one of the worst recessions in its history. With the end of the seventies and the beginning of the eighties, the energy crisis left by the Iranian revolution began to be felt, which led to an acceleration of oil prices. Analysts blame US monetary policy for controlling the crisis that led to inflation in 1982 between 5% and 10%.

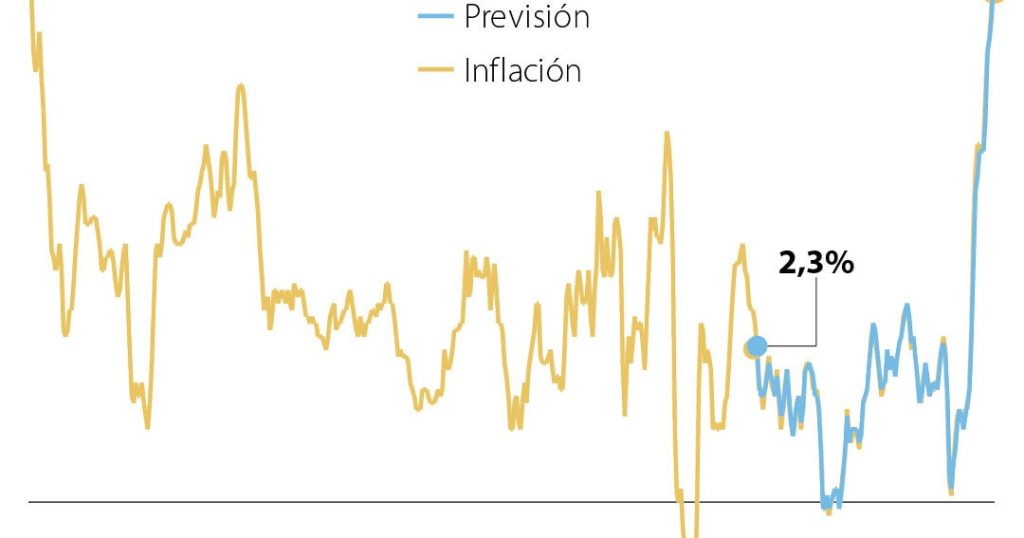

Yesterday, the CPI for the US union reached 7.9% in February, a level not seen since 1982. Now, on Wall Street, analysts are predicting that disruptions in the oil and raw materials markets due to the Ukraine crisis will add more cost pressures in the coming months.

The US Department of Labor stated that higher energy prices, including increases in gasoline prices, helped drive inflation, along with gains in the cost of groceries, restaurant meals, transportation services and clothing. An analysis by Credicorp Capital notes that “we consider that for the monetary authority, inflation in February 2022 presents a dual challenge, varying in time frames for the policy horizon. In the very short term, it should continue to prioritize managing inflation expectations; however, in the medium term Considerations of financial stability and economic growth will dominate the agenda.”

Excluding volatile energy and food prices, the Labor Department said consumer inflation rose at an annual rate of 6.4% in the second month of the year, compared to a margin of 6% in January.

12-month rates are not seasonally adjusted. The Consumer Price Index measures what consumers pay for goods and services, including groceries, clothing, restaurant meals, entertainment and vehicles. On a monthly basis, the CPI rose 0.8% seasonally adjusted in February.

Gasoline prices are up 6.6% from January, an unrevised annual increase of 38%. Grocery stores increased 1.4% m/m at an annual rate of 8.6%. On the other hand, rental costs increased by 4.7% during the year.

The market does not rule out reaching an extreme peak

Some economists believe that inflation is likely to peak soon, possibly as soon as this month (report due April 10). Which is that the war in Ukraine increases the likelihood that the peak will be higher and the descent to lower levels will take longer. “The war is disrupting momentum on the supply chain front,” said Kathy Bostancik, chief economist at Oxford Economics. It has now raised its annual inflation forecast for the end of 2022 to a level closer to 4% instead of 3%.

“Beeraholic. Friend of animals everywhere. Evil web scholar. Zombie maven.”

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/Y3HUCOBEKNGZLJNJKJALENF634.jpg)

More Stories

Oil, renewable energy and the largest submarine cable

Mexican Stock Market for Europeans: Azimut will launch the UCITS Variable Income Fund

What is the relationship between the price of Nvidia and Bitcoin?