The eurozone periphery is re-emerging as a headache. The European Central Bank hasn’t made a move yet, but investors have already priced in zero interest rates and gradual increases to combat inflation. Although rising revenue has been a mainstream trend throughout 2022, it has played a special role in recent weeks. No reference escapes this trend, but it is the southern European countries that are once again focusing on punishing investors.

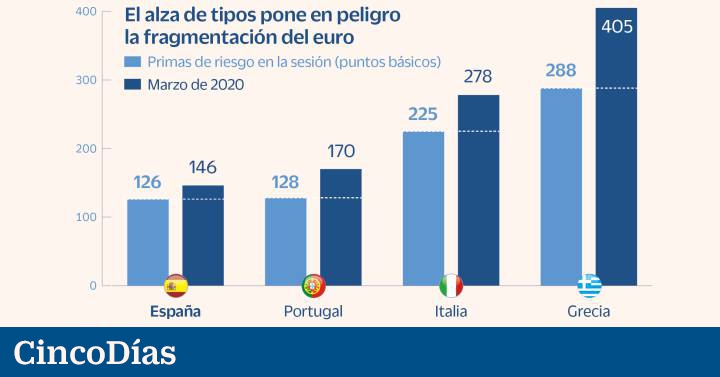

Risk premiums, which made headlines in the debt crisis a decade ago, are back in the spotlight. Last week, the spread between German and Italian bonds due in 2032 widened by 12 basis points and reached 225, a move that Spain, Portugal and Greece do not escape with risk premiums at 126, 128 and 288 points, respectively. . These levels are starting to make you dizzy, but they are still far from the levels recorded in March 2020. Before the European Central Bank launched the Anti-Pandemic Purchase Program (PEPP), country risks in Italy, Spain and Portugal were between 278 and 146 basis points.

The difficulty that the European Central Bank faces in implementing its new monetary strategy is the dispersion of interest rates among the various countries in the region. The European Central Bank will have to adjust its strategy to reduce financial retail risks,” says Philip Wachter, head of economic research at Ostrum AM. Controlling inflation and preventing the withdrawal of stimulus from reviving past ghosts are the two big challenges that Christine Lagarde will face in the coming months. The monetary institution in giving details but reiterated the commitment to avoid fragmentation.

ING Research points to reinvesting the PEPP portfolio as a first line of defense, a strategy that will run until at least 2024. Although net purchases ended in July, experts say the reinvestment remains a sign of permanence that has been necessary in a period when less favorable references are expected to suffer more stress. Fundamentals, which were overtaken in periods of quantitative easing, are now the main guarantee for investors. Economic imbalances, such as huge debts and high deficits, threaten to put financial recovery and sustainability to the test.

Although nerves have drawn investors in recent days, ratings agency Moody’s has tried, with little success, to allay concerns. The company notes that as long as countries maintain investor confidence and the European Central Bank does not have to raise interest rates quickly, it will take time for the rate hike to affect funding costs increase. Moody’s explains that in recent years countries have done their part to protect themselves from rising interest rates and have taken advantage of good financial conditions for long-term borrowing. The goal is nothing more than to extend the maturities of the debt. Spain is the best example of this trend. The average life of a debt portfolio is 8.2 years. They noted from the agency that “healthy economic growth in nominal terms should also ensure continued deleveraging.”

“Beeraholic. Friend of animals everywhere. Evil web scholar. Zombie maven.”

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/Y3HUCOBEKNGZLJNJKJALENF634.jpg)

More Stories

Oil, renewable energy and the largest submarine cable

Mexican Stock Market for Europeans: Azimut will launch the UCITS Variable Income Fund

What is the relationship between the price of Nvidia and Bitcoin?