Chancellor of the Exchequer , Janet YellenThis Sunday indicated that The federal government won’t bail out Silicon Valley Bank (SVB Financial)but he works to help anxious depositors with their money, as he expressed on the TV show “Face the Nation” in CBS.

Federal Deposit Insurance Corporation (CFSD), the feed it and the Federal Insurance Corporation Formed a working group around SVB Financial to launch a Deposit Protection Scheme up to $250,000, while also working on Possible liquidity solutions for some companies that used the entity for his locker.

“The US banking system is really safe and well-capitalized. It’s resilient.”

It is different from 2008

there Fears that some workers across the country will not receive their wages Starting next week because there are thousands of enterprise customers, especially tech startups. “Anytime a bank goes bankrupt, especially a bank like Silicon Valley Bank with billions of dollars in deposits… that’s obviously a concern.. From the point of view of depositors, many of whom may be small businesses, they depend on access to their money to be able to pay their bills and employ tens of thousands of people,” He said.

Yellen did not provide details of the government’s next steps, however He stressed that the situation is completely different from the financial crisis of nearly 15 years ago, which led to bank bailouts to protect the industry. “Let me just say that We want to make sure that problems in one bank do not spread to others who are otherwise healthy. The goal is always supervision and regulation to make sure infection does not occur. During the 2008 financial crisis, there were large systemic investors and bankers who were bailed out, and we’re certainly not looking to do that again.”

“But we are worried about our depositors and focus on trying to meet their needs.“To resolve the situation in the best possible way,” he added. With Wall Street on edge since Friday, Yellen tried to reassure Americans that… There will be no ripple effect after the collapse of the Silicon Valley bank.

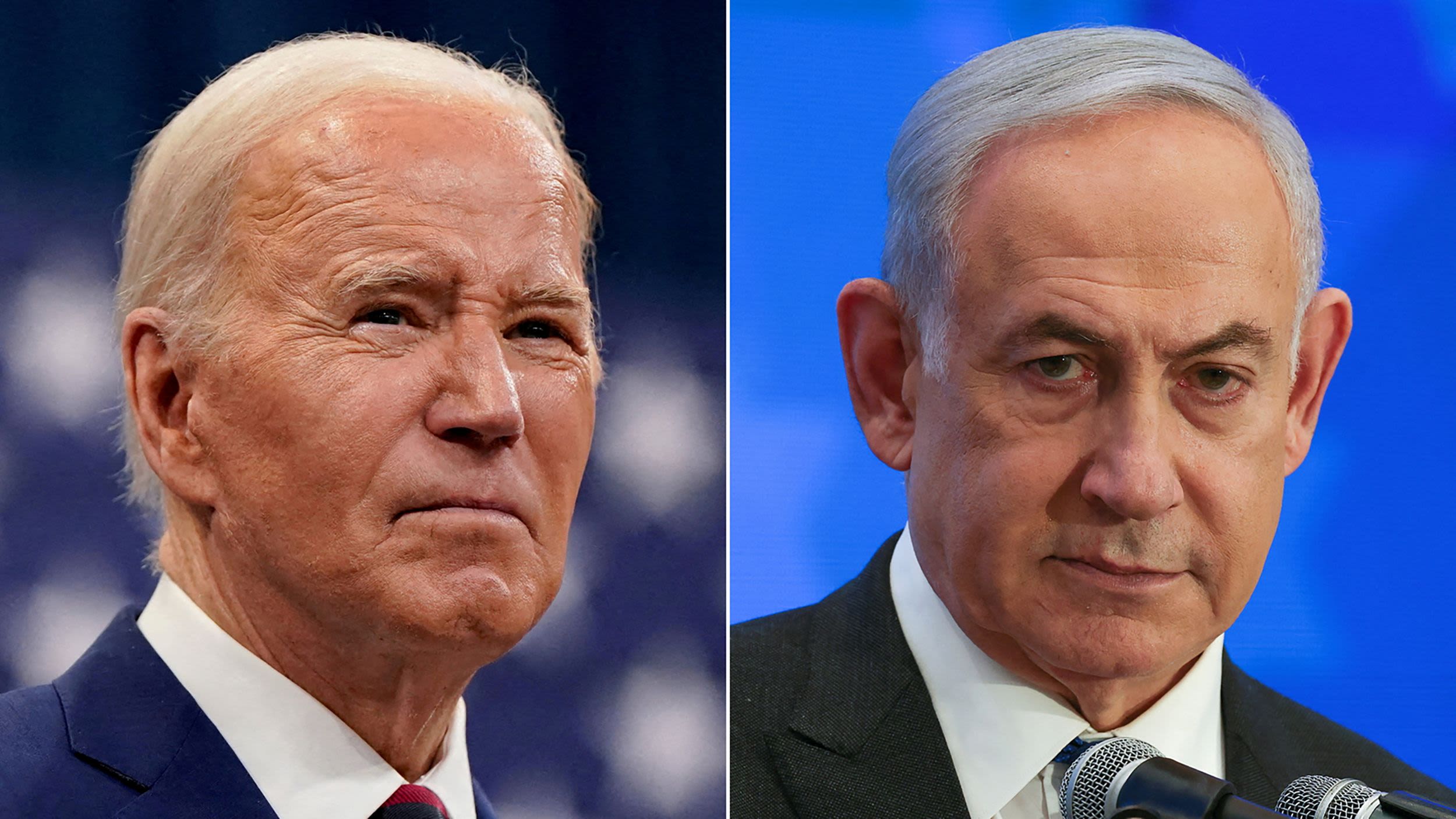

“he The US banking system is really safe and well capitalized. He is resistantadded the head of financial stability for Joe Biden’s government. The Silicon Valley bank is the sixth-largest bank in the country with just over $175,000 million in deposits and was the second-largest retail bank failure in US history after the collapse of Washington Mutual in 2008 Except for the investment bank Lyman or insured AIG.

“We heard from those depositors and other people involved this weekend. Let me just say that I’ve been working all weekend with our bank regulators To design appropriate policies to address this situation. “I can’t provide more details at this time,” said the head of the treasury.

“Beeraholic. Friend of animals everywhere. Evil web scholar. Zombie maven.”

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/7RZ4PSPCSVHX5PY7Y7A4F2P2SE.jpg)

More Stories

Room Mate will collaborate with two major international hotel companies

Chipazo lottery results: Who are the new millionaires?

The largest bank in America says goodbye to Wall Street after 150 years