WiZink will raise capital by 250 million through an investment backed by Värde Partners and other international investors, with the aim of managing the potential impact of renewable card claims and promoting the implementation of its strategic plan, which is focused on becoming the leading digital bank in consumer finance for the Iberian Peninsula, as reported Thursday. .

“With this capital increase, we want to significantly strengthen WiZink’s financial position, which will allow it to further implement its business plan, which includes taking advantage of growth opportunities that may arise in the market, and managing the potential impact of litigation for deferred payment cards,” WiZink informed.

Similarly, the bank indicated that the capital injection would allow it to make “new institutional projects and investments” to continue growth and complete the diversification of the business, which it began last year with the launch of its new line of personal loans, Entry. into the auto finance business through the acquisition of Lendrock or the launch of its new portfolio of credit cards segmented by customer profile.

In order to raise capital, Mulhacen, an indirect shareholder in the bank, reached an agreement with Värde Partners and major international holders of its bonds, which supported, among other aspects, the alignment of the bond maturity with the terms of the bank’s business plan.

Mulhacen is the Singapore investment vehicle through which Värde Partners acquired a 49% stake in the digital bank, which at that time was in the hands of Banco Santander, with which it became the sole shareholder of WiZink.

Mulhacen will issue a new vehicle, financed 50% by Värde and 50% from existing bondholders, to fund WiZink’s capital increase. The partial capitalization of the existing Mulhassen bond will be renamed at 55% of its current principal and will extend its maturity to 2026.

Thus, Värde Partners will remain the majority shareholder in Mulhacen with a 60% stake, while the remaining 40% will be in the hands of bondholders.

Investor support

The deal does not include changes to WiZink’s management or its board of directors, which has a majority of independent board members.

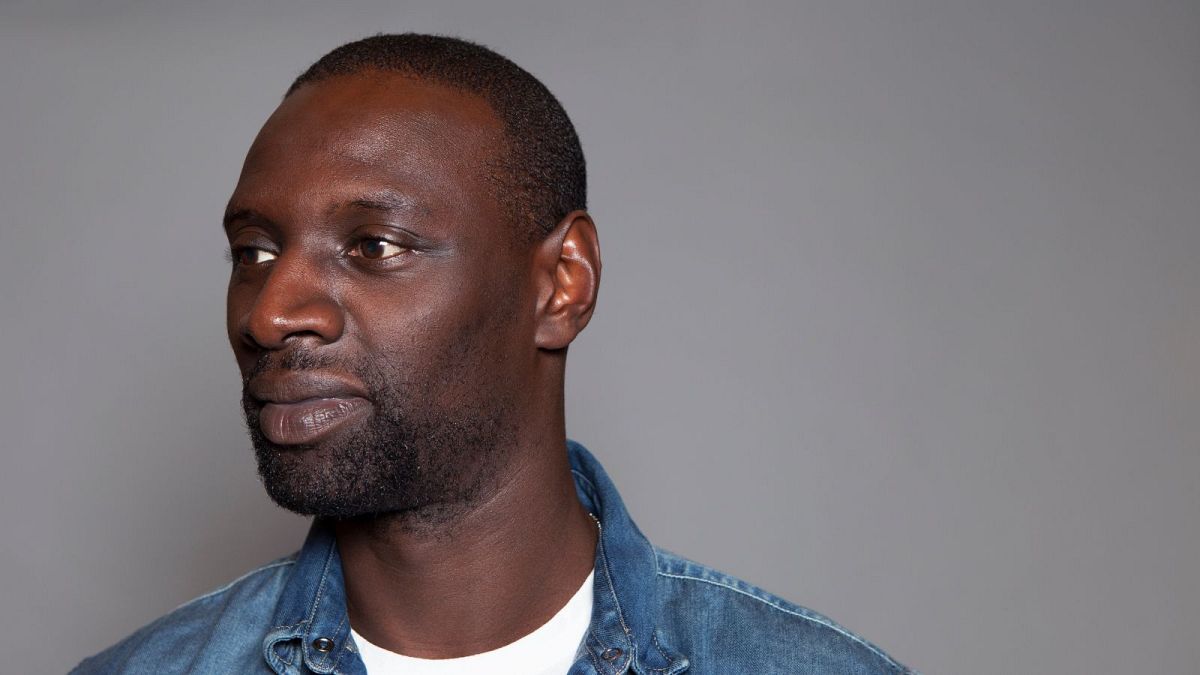

WiZink CEO Miguel Angel Rodriguez Sola confirmed that the capital increase demonstrates Värde Partners’ support from international investors for the bank’s digital growth strategy.

“This operation allows us to enhance the implementation of our strategic plan to lead the digital consumer finance market in the Iberian Peninsula and to further improve the value proposition we provide to our clients,” assessed the executive.

“Beeraholic. Friend of animals everywhere. Evil web scholar. Zombie maven.”

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/36QW54T3MZGELCUSJOKHDT5HU4.jpg)

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/JDCDUBJMP5HNBFLGXSEZJ3VPBY.jpg)

More Stories

Chipazo lottery results: Who are the new millionaires?

Closing value of the dollar in Bolivia on April 29 from USD to BOB

Breaking: EUR/USD fell slightly after the German CPI reading