Bloomberg – Asian stocks poised to rally on Monday after a chaotic week for financial markets that ended on Friday with a rally in US regional banks and an increase in risky assets.

Strong jobs data eased fears of a recession in the US, improving sentiment that sent Treasurys lower, and Wall Street’s favorite measure of volatility, the VIX, led to a four-day rally.

Equity futures pointed to gains of just under 1% in Hong Kong and Australia. Japanese contracts eased slightly as traders returned from their domestic holidays.

Wall Street’s advance snapped the S&P 500’s longest losing streak since February, rising 1.9%. The KBW Bank Heavy Securities Index rebounded from its lowest level since September 2020.

The Nasdaq 100 rose 2.1%, and Apple Inc.’s strong results helped. On boosting the tech sector, the world’s most valuable company rose nearly 5%.

The major currencies were little changed in early trading on Monday, after a measure of the dollar’s strength ended the week down 0.6%. The dollar advanced 0.3% against the yen.

Bond yields rose in Australia and New Zealand after treasury yields rose on Friday.

US employment data showed an acceleration in the increase in hiring and wages for workers in April, indicating resilience in the labor market and inflationary pressures in the face of headwinds.

The strength of the numbers also increases the possibility that the Federal Reserve will keep interest rates higher for longer, potentially keeping the door open for an 11th consecutive hike in June.

Interest rates on swaps linked to Fed meetings, which briefly projected a July cut on Thursday, rose to levels consistent with a stable interest rate through September, followed by at least quarterly cuts at the end of the year.

Even though stocks rose on Friday, investors still have a lot to worry about. The decline in US bank stocks has brought the S&P 500 financial index to the brink of sliding below its 2007 peak.

Meanwhile, Treasury Secretary Janet Yellen argues that “there are no good options” for resolving Washington’s impasse over debt limits without Congress raising the bar. He even warned that resorting to the Fourteenth Amendment would lead to a constitutional crisis.

Investors will be watching this week’s release of the core CPI, which excludes food and energy and is closely watched by the Federal Reserve. An increase of 5.5% is expected in April over the previous year.

In Asia, the focus will be on Chinese trade numbers due in the first half of the week and inflation numbers due on Thursday.

Elsewhere, Oil opened higher as investors assessed a complex global demand outlook after a period of volatility. Gold hardly changes.

Main events for this week:

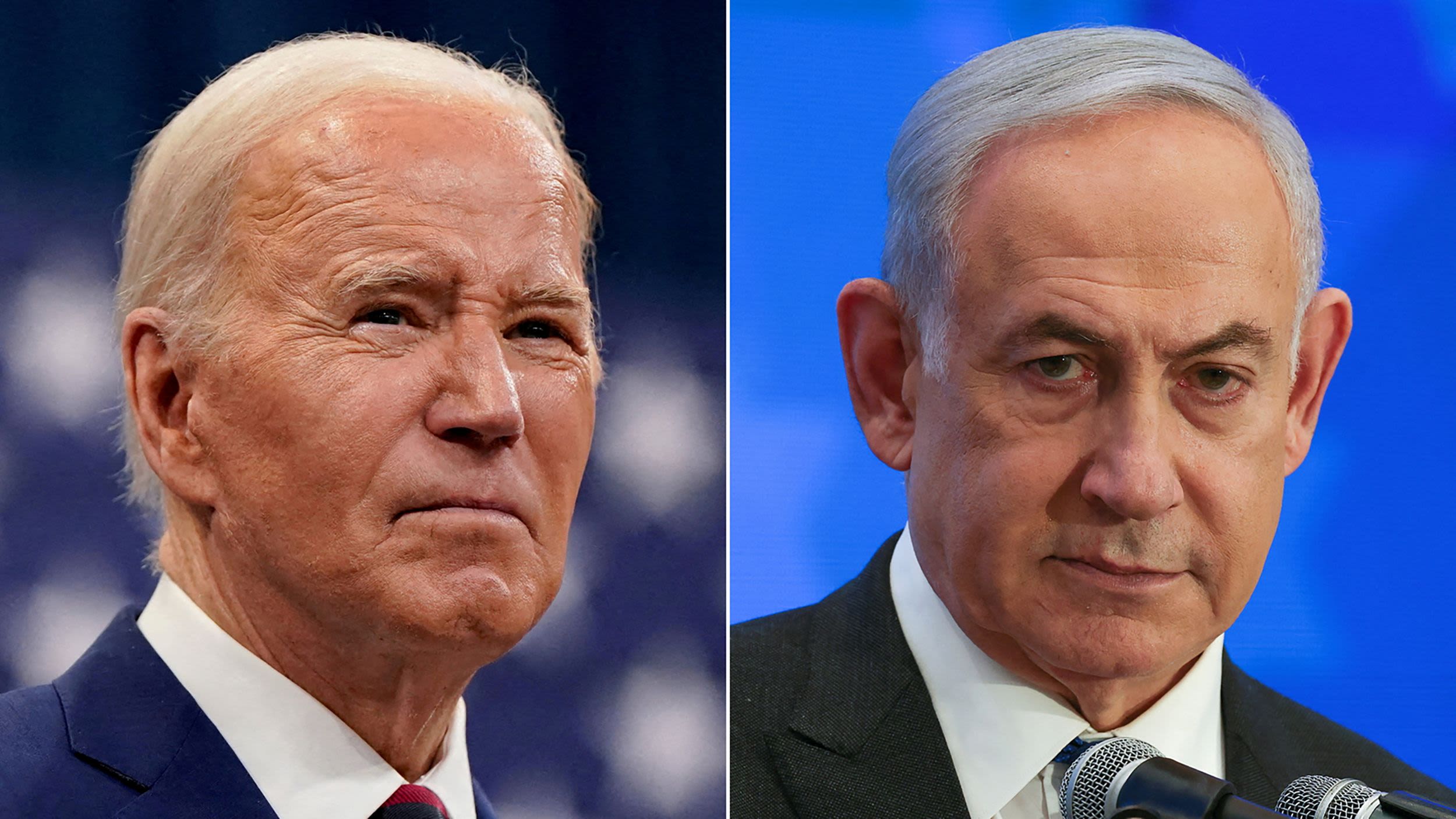

US Wholesale Inventories Monday: US President Joe Biden is set to meet with congressional leaders on a debt limit.

TUESDAY: John Williams, President of the Federal Reserve Bank of New York, speaking to the Economic Club of New York, US CPI.

Wednesday: PPI and CPI for China.

Thursday: UK: interest rate decision, industrial production, GDP, US PPI, initial jobless claims, meeting of G7 finance ministers and central bank governors in Japan. University of Michigan Federal Reserve Governor Philip Jefferson and St. Louis Federal Reserve Chairman James Bullard participate in a roundtable on monetary policy at Stanford University,

Friday: Some major market moves: S&P 500 stock futures were little changed at 8:17 a.m. Tokyo time. The S&P 500 rose 1.9% on Friday. Nasdaq 100 futures have changed little. The Nasdaq 100 was up 2.1%, Nikkei 225 futures were down 0.2%, Australia’s S&P/ASX 200 futures were up 0.9%, and the Hang Seng Index futures were up 0.8%.

Currency exchange rate: The Bloomberg Spot Dollar Index was little changed, and the Euro was trading at $1.1018. The Japanese yen fell 0.3 percent to 135.19 per dollar.

The yuan was trading at 6.9195 to the dollar. The Australian dollar was trading at $0.6753.

Digital currenciesBitcoin fell 0.5% to $28,822.18.

Ether fell 0.3% to $1,914.3.

Bonuses: The 10-year Treasury yield rose six basis points, to 3.44%. The yield on the Australian 10-year note rose nine basis points to 3.41% commodities. A barrel of West Texas Intermediate crude rose 0.3 percent to $71.57. The price of spot gold has not changed.

“Beeraholic. Friend of animals everywhere. Evil web scholar. Zombie maven.”

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/7RZ4PSPCSVHX5PY7Y7A4F2P2SE.jpg)

More Stories

Room Mate will collaborate with two major international hotel companies

Chipazo lottery results: Who are the new millionaires?

The largest bank in America says goodbye to Wall Street after 150 years