China remains a hub

The show started with The problem the United States faces with China, This goes beyond ideological and social reasons, although it does not exclude those reasons. However, he does comment that there is one thing to keep in mind It is simply economic competition.. Unlike Japan, which was a US ally in the 1980s and was crushed by its many housing problems, China's story is that it is a competitor with a very large share of purchasing power parity-adjusted GDP.

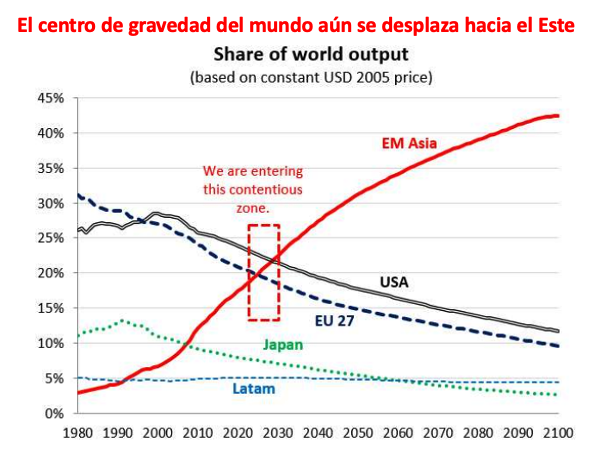

while The United States and Europe have seen their share of GDP decline in the past decadeAs for the rest of the world, it increased, but it was concentrated in one region, which is not Latin America Emerging Asia, led by China, followed by Taiwan, Malaysia and IndonesiaIndia has not yet appeared. but In the future, it may be a combination of India's rise and China's declineBut it is emerging Asia, as Washington experts estimate.

The expert comments on the decline in industrial investment in China, and expects that production will likely move to other Asian countries instead of Eastern European countries, such as Poland. Stephen highlights the competitive nature of Asia as a well-equipped machine with strong economic interactions within it. The discussion addresses how Chinese factories continue to produce goods for export through intermediaries such as Vietnam or Mexico. Overall, Jin believes Asia's rise is inevitable and cautions against underestimating its excessive competitiveness in the future.

Europe's position in this competition between the United States and China is very important, because siding with one or the other could lead to very important consequences. Germany is distinguished by its early penetration of the Chinese economy, as European car manufacturers derive a large portion of their profits from China.

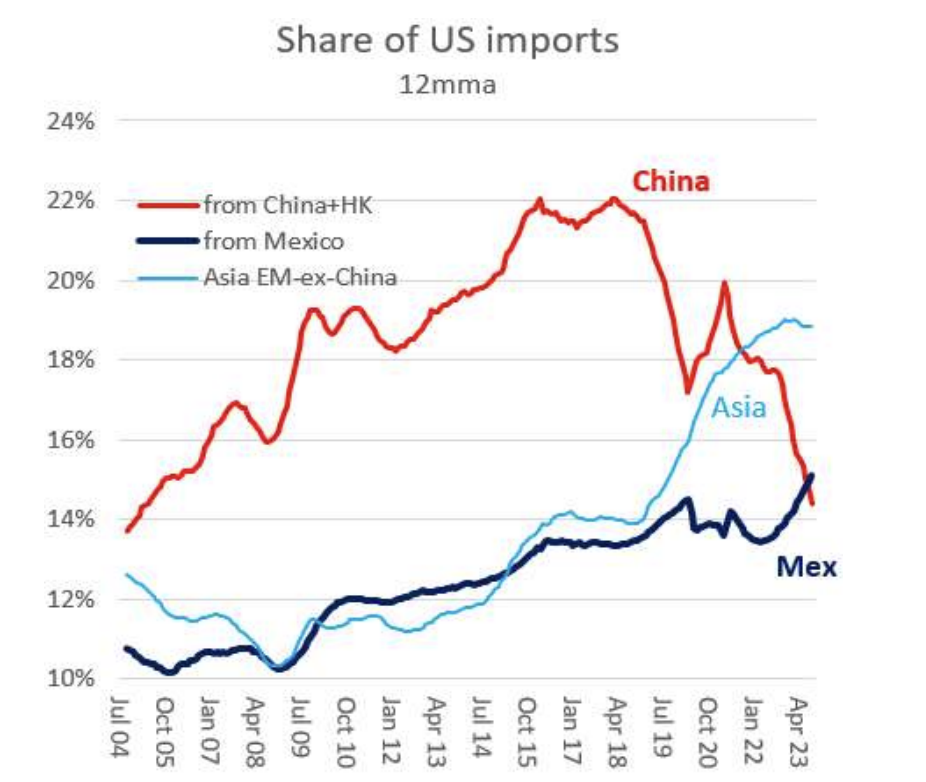

Global trade is still strong, but look who has replaced China:

If you look at US imports from different countries from China, you can see that US imports directly from China have declined. In fact, Mexico is now a larger source of imports for the United States than China. And Asia too. The rest of Asia imports much larger quantities. You can see the increase. but What people don't talk about, and some of us know, is that many of these numbers from Asia and the rest of Asia and Mexico are from Chinese factories.. That's either The Chinese shipped intermediate goods to Vietnam, assembled the products in Vietnam, and then exported them to the United States. Or they invested in factories in Mexico and produced products in Mexico for export to the United States. They are still Chinese.

The Chinese consumer is still a little present

Despite high savings rates, consumers are reluctant to spend due to a lack of confidence. It is important for China to reduce investment (I) and increase consumption (C), especially in housing.

Elections in Taiwan, interest in who wins could mark a geopolitical milestone

January 13, 2024 is a key date that can mark the relationship not only between China and Taiwan, but between China and the United States. The Democratic Progressive Party's independence candidate holds 32% to 35% of the vote, but should prevail. The expert noted that two-thirds of voters support candidates who call for peace and cooperation with China. He adds: “If Taiwan's next president seeks peace rather than provocation, that would give China and the United States more room to maneuver.”

In addition, he commented that the risk of war on Taiwan in the near future has decreased significantly, but Beijing has not yet acknowledged the presence of a “giant panda in the room.”

Optimism about a soft landing in terms of GDP but a hard landing in inflation

The expert comments that there is some tension among investors despite the decline in inflation. He emphasizes the role of psychology in managing expectations about inflation and warns of the potential consequences if the Fed breaks confidence. Inflation has fallen from 9.1% to current levels, but the Fed is not comfortable with anything higher than 3%. “When you have a trend like this, it points to a decline and could prompt the Fed to cut interest rates sometime in 2024.”

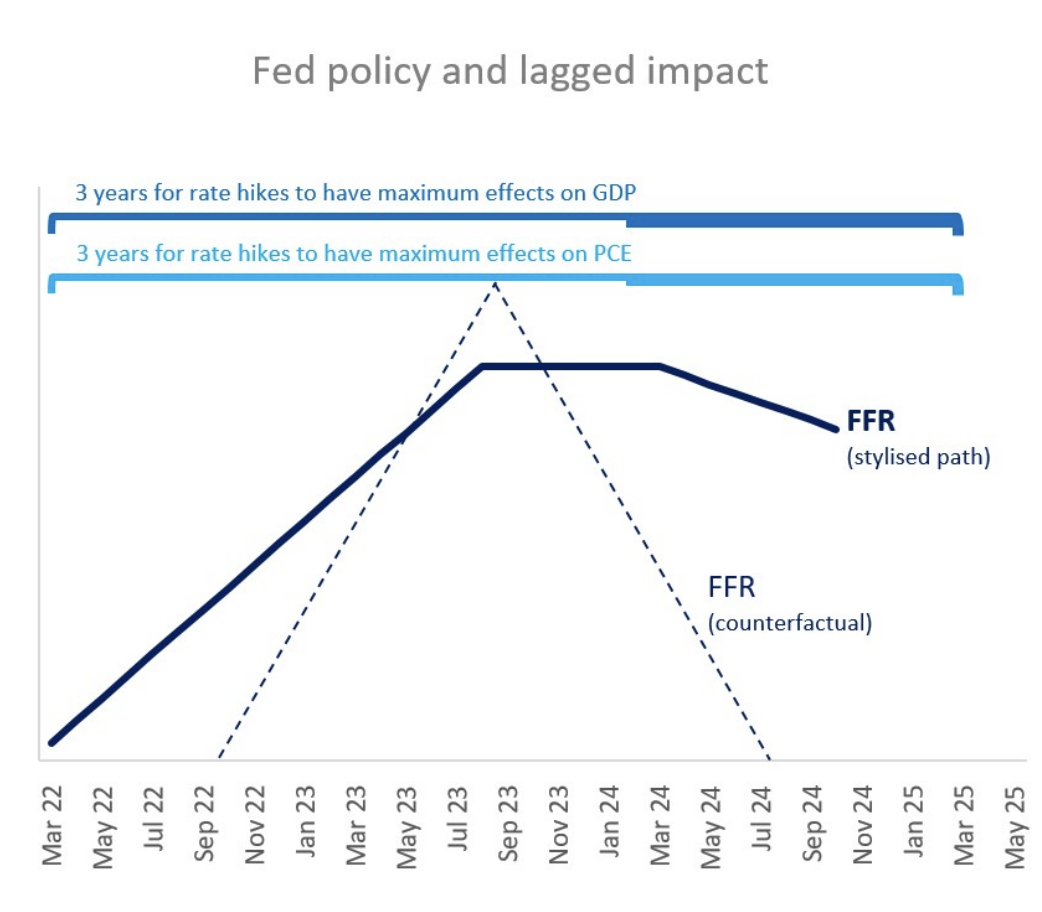

Jane discussed the impact of technology on hiring and how AI can impact the accuracy of forecasts. Consider the risks Deflationary pressure causes demand shortagealong with potential measures by central banks to stimulate demand through Lowering interest rates or quantitative easing (quantitative easing). As Stephen points out, the Fed may make a mistake in monetary policy, as it did in 2021, and the debate over plans to stimulate the economy and their impact on inflation will continue to be between Larry Summers and Olivier Blanchard. Furthermore, he notes that we can expect the Fed to be more flexible in an election year, considering that it takes 3 years for monetary policy for inflation, GDP, and employment to turn negative. For Stephen, US inflation will fall below 2% in the second quarter, forcing the Fed to cut interest rates or quantitative easing.:

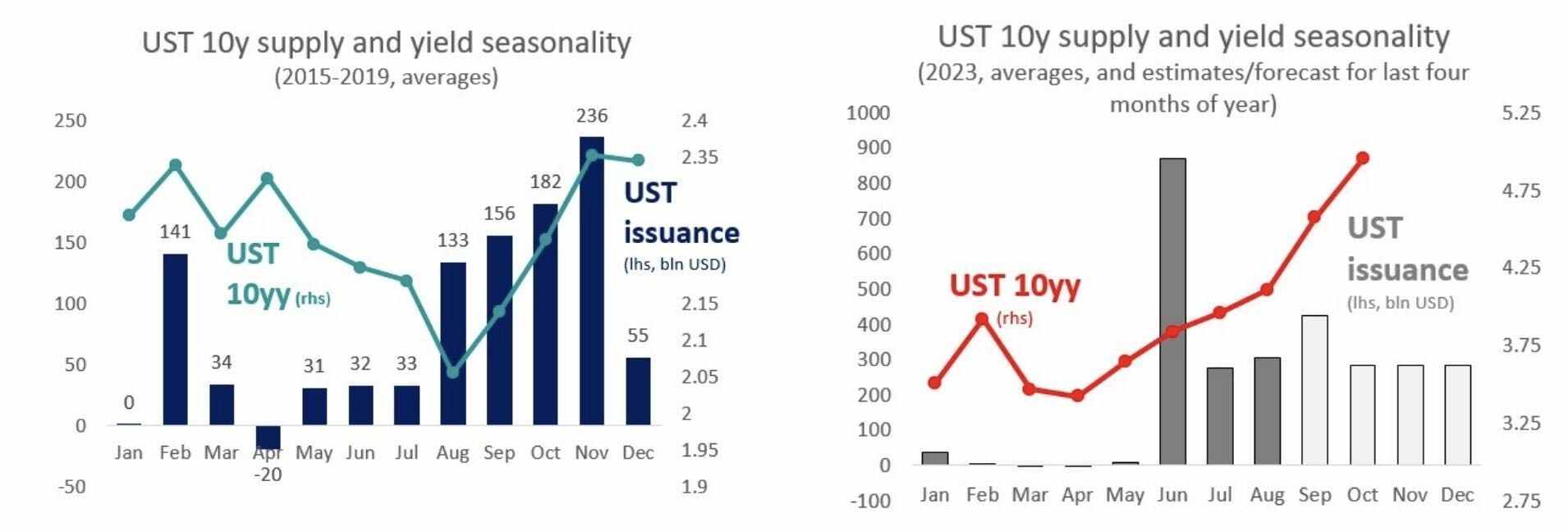

The biggest problem in the United States is not the spending ceiling, but the debt itself. It has also implemented an unusually expansionary fiscal policy in recent years, and some of these measures are still in place. . With an oversupply of UST in the summer of 2023 (1.4 trillion T-bills), which was 7 times higher than the historical average.

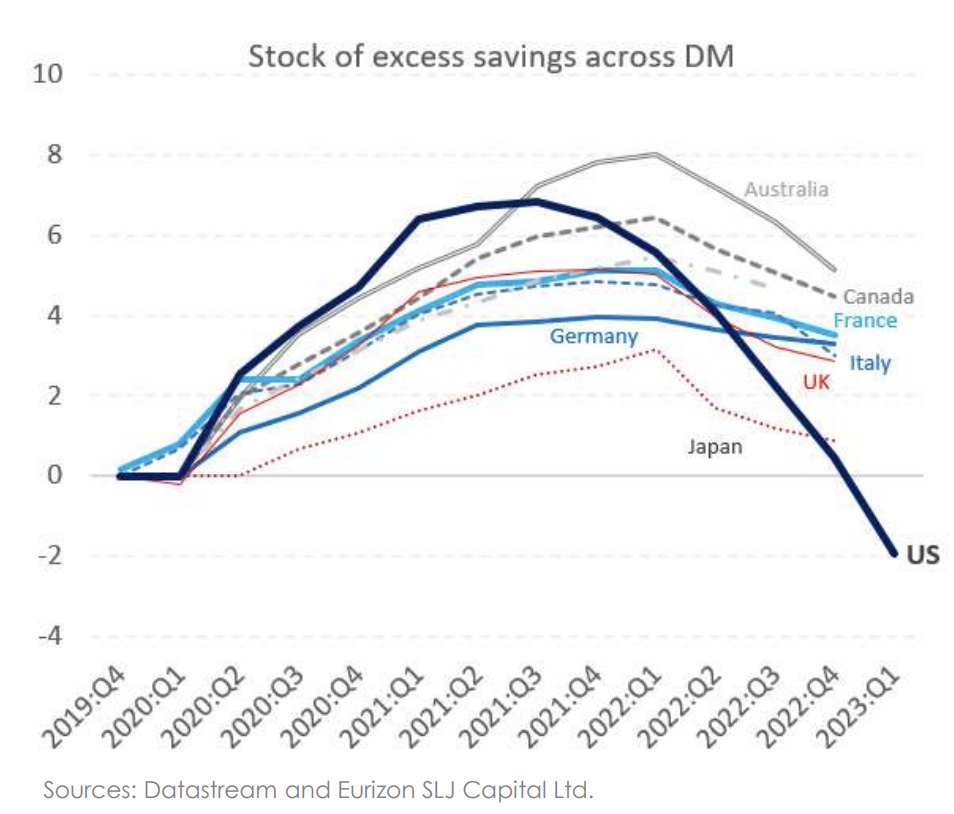

Stephen says the global economic outlook is good, referring to consumption. “People have money in their pockets, especially in countries outside the United States and this will help them in 2024.”

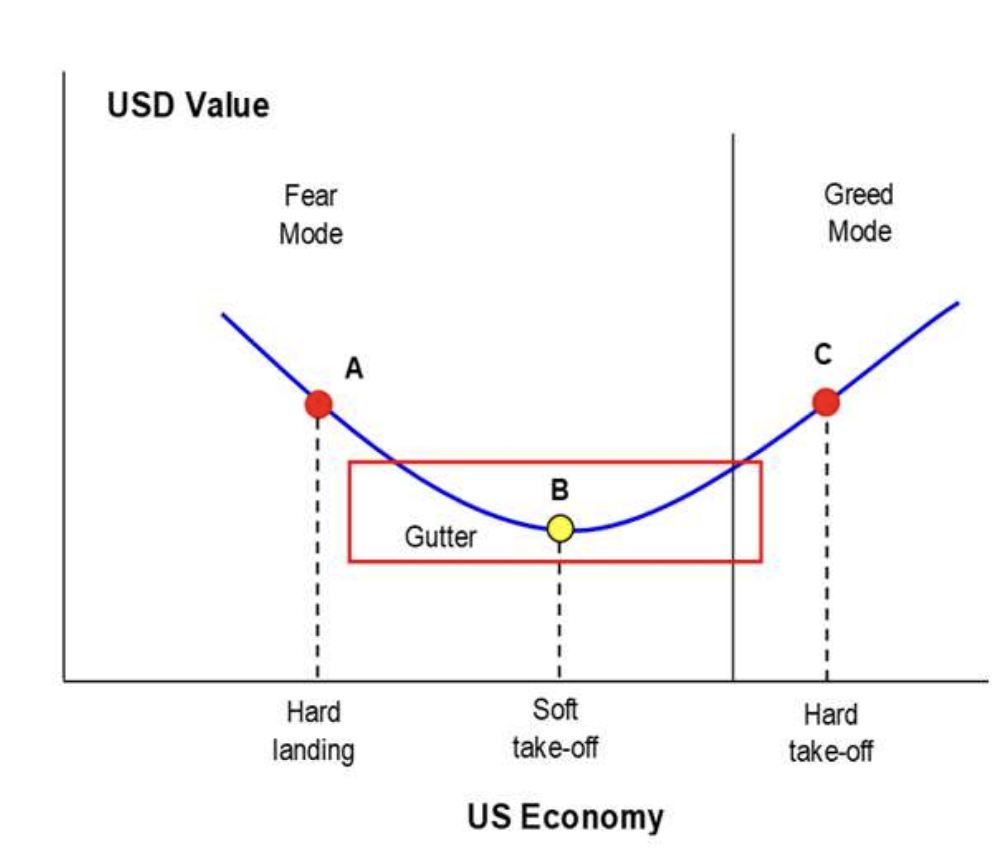

Regarding currencies“I'm a dollar positive guy.” However, at the moment I'm not, as Stephen points out, and that's because of the structural impact on GDP, and that's where it recharges. “dollar smile”. On the horizontal axis is the relative growth rate of the US economy compared to its trading partners. This means that the United States is growing faster than the rest of the world. This usually happens when the United States emerges from a recession, leading the world to recovery. You tend to be the opposite here. When the United States of America breaks, something happens in the United States of America, just as it did in 2008, the United States of America collapses, taking the entire world with it. The United States is a strong country, but it is tougher than the rest of the world. In both directions, the dollar tends to rise. “There is only one currency in the world that has these complex relationships, and that is the US dollar.”

A new WhatsApp channel for investment professionals.

Investment strategies launches WhatsApp channel for asset managementwhich targets investment professionals, private bankers, fund selectors and distributors, and financial sector professionals.

Follow us easily from your mobile phone on our new communication channel Register here.

“Beeraholic. Friend of animals everywhere. Evil web scholar. Zombie maven.”