Good evening! Arrival Line brings you the daily summary of closing markets

🗽 On the streets of Wall Street:

On Friday, US stocks closed in the red, after it became known that the country continued to add jobs strongly in September, indicating that The labor market remains flexible When dealing with interest rate hikes by the Federal Reserve.

The 263,000 new jobs number supports expectations that the Fed will continue the tightening cycle. Expectations led to a decline in stocks. The S&P 500 closed down 2.80% after nearly 95% of the companies included in the index incurred losses.

A few days ago, the S&P 500 posted its biggest gain for two consecutive days since the start of the pandemic, so those gains gave it its best week in a month despite today’s drop. On the other hand, the Dow Jones lost 2.11%, while the Nasdaq Composite lost (CCMPDL) It closed at 3.80%.

Wayne Thien of Brown Brothers Harriman believes that a 75 basis point Fed rate hike in November is now “a given” and another rate hike of the same level in December becomes a “real possibility”.

New York Fed President John Williams said today that rates should rise to 4.5% over time, But the speed and maximum point of tightening will depend on how the country’s economy progresses. Several of his peers confirmed during the week that inflationary pressures remain high and that Market volatility will not deter them from continuing the bullish cycle.

🔑 Keys of the day:

Oil posted its biggest weekly gain since March on Friday amid supply concerns following the announcement by the Organization of the Petroleum Exporting Countries (OPEC) and its allies. Reducing production by two million barrels per day, The biggest drop since the start of the epidemic.

Russia also confirmed during the week that it will not sell its production to countries that adopt the price limit proposed by the United States, Which increases the uncertainty about supply.

The rise in prices this week is a change in the direction of oil, Which last week ended its worst quarter since 2020. West Texas broker To settle in November US$92.64 per barrel, After rising more than 16% in a week. International reference Brent, for delivery in december, It closed at $98.21.

Supply concerns appear to be the driving force behind market action this week. Putting demand concerns on the back burn of oil prices, Despite the fact that it remains the center of attention in stock markets, analysts at wholesale fuel distributor TACenergy wrote in a note to clients.

📉 bad day:

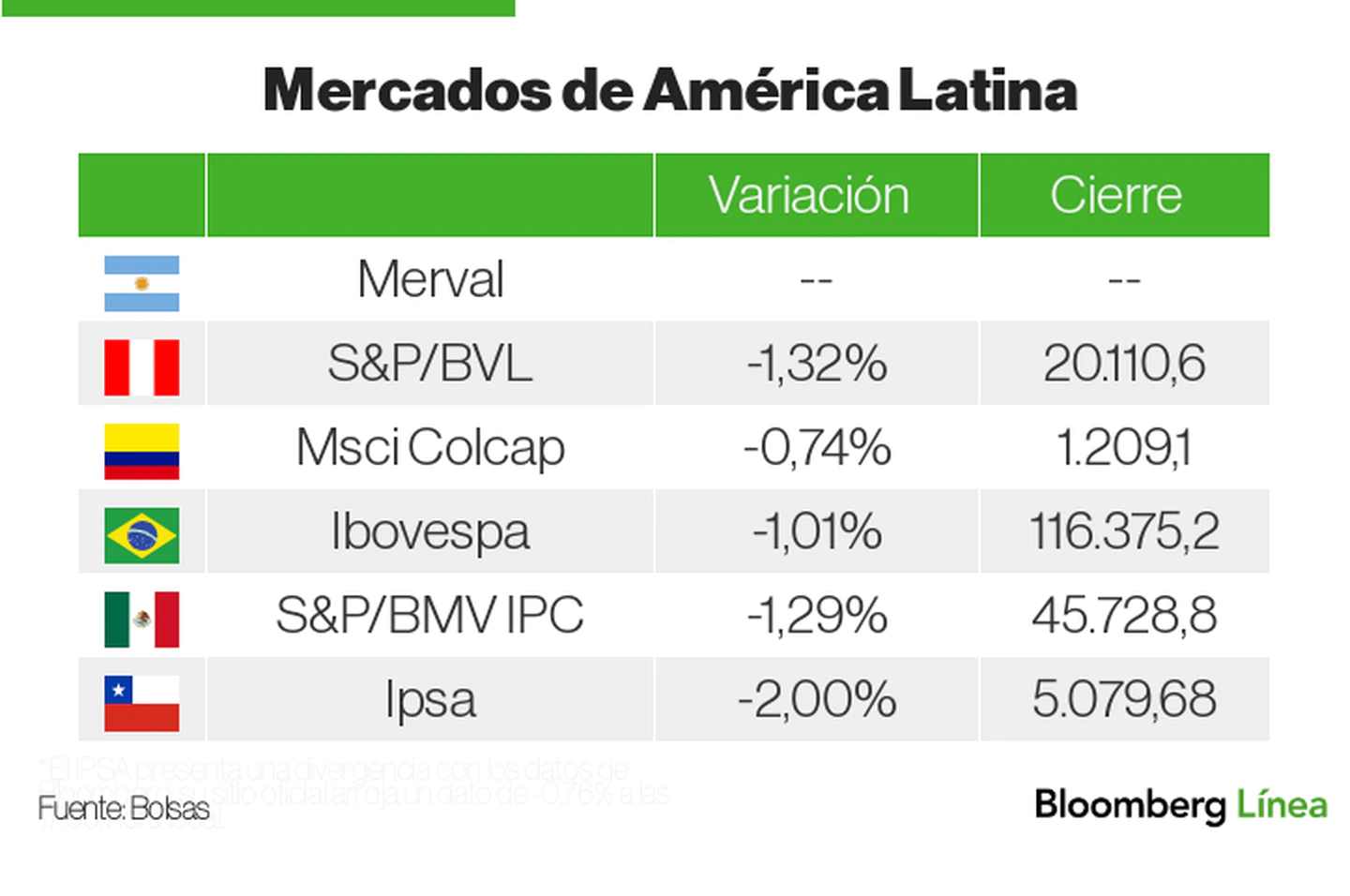

Stock markets in Latin America were affected by the mood of the American markets and the major indices in the region closed with losses.

epsa chile (IPSA) This indicator was the most declining among its peers in Latin America and closed the week with three consecutive days in the red. Friday was affected by the performance of the non-essential consumer products and industries and materials sectors.

According to economists Adriana Dupita and Felipe Hernández from Bloomberg EconomicsAnd the Chile is set to raise its 11th consecutive interest rate next week Amid inflation represents one of the greatest complications for the administration of President Gabriel Borek.

They said that despite government efforts and central bank tightening cycles, inflation is still far from returning to target. Which means that policymakers are not going to deviate from their hard line anytime soon.

The S&P / BMV IPC FavoriteMeanwhile, it was the second worst performer during the session after losing -1.29% and After Thursday, the region’s best-performing measure led the gains. The impact of the behavior of materials, basic consumer products and industry sectors on the index.

A mission from the International Monetary Fund indicated, on Friday, that after recording growth in the first six months of the year, Mexico’s economy, the second largest in Latin America, will slow in the coming quarters.

Mexico faces a challenging environment, with global inflation soaring. Although recovery from the height of the Covid-19 pandemic has been relatively gradual, The mission said inflation had accelerated to levels not seen in two decades.

Merval Argentina (Merval) She did not work today due to a holiday in the country.

The truth about dinner:

Generation Z feels lost between the new and the old banking models. Also called centenary, young people between the ages of 12 and 26 have established their financial base in an inflationary environment and are faced with difficult decisions to achieve their financial goals.

Although nearly two-thirds of centenarians are actively saving to achieve their financial goals, 85% said they face financial barriers. Members of Generation Z are more likely to combine financial ambition with a desire to live comfortably than other generations, according to the Bank of America’s Best 2022 Best Financial Habits survey.

The centenarians do not know the world without Google, they are digital natives with different consumption habits than those of previous generations, which presents a particular challenge to traditional enterprises.

➡️ Read more about The three things this generation is looking for in their finances

“Beeraholic. Friend of animals everywhere. Evil web scholar. Zombie maven.”

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/VKLL7VFKVFHLFL7M4GYNPY2O5A.jpg)

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/XAC7BNFM4RHILJYFO72YPJTMQ4.jpg)

More Stories

Trump’s media audit firm accused of “massive fraud”

Opening value of the dollar in Brazil on May 3 from the US dollar to the Brazilian real

Numbers that gave luck to the new winners of Chipazo