The ADP employment report for June was released today at 14:15 CEST. As usual, the report was highly anticipated as it is one of the final hints ahead of the official NFP report for June which is due out tomorrow at 2:30pm CEST. The market expected ADP data to show an increase of 230K jobs. While ADP has had a somewhat poor track record of predicting NFP data in the past, it must be said that the readings of the two over the past three months have been pretty consistent.

The actual ADP data for the month of June turned out to be a huge positive surprise and showed a job gain of 497,000! The release triggered a backlash in the US dollar market, with EURUSD down around 0.2% in the first few minutes after the release. Stocks were mixed as European index futures rose while US index futures fell. Gold fell about 0.4% amid a stronger dollar and a jump in yields (two-year US yields were up more than 5%!)

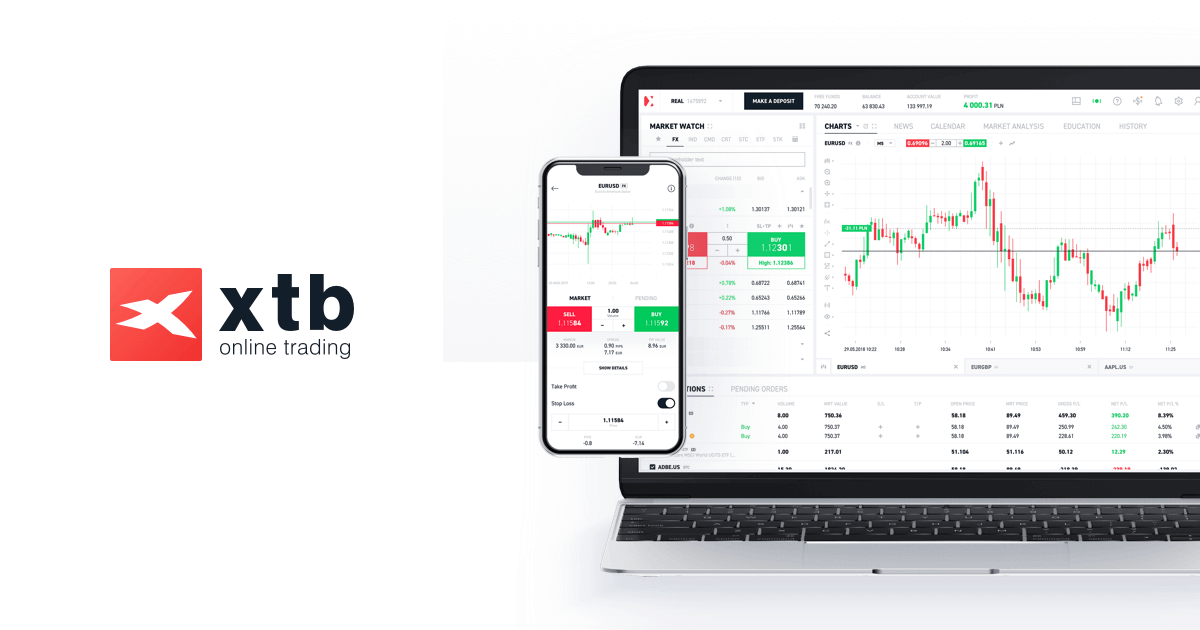

EURUSD Retreats Previous Gains After Higher ADP Data! The pair is now trading slightly on the day. Source: xStation5

This material is advertising communication as understood in Article 24.3 of Directive 2014/65 / UE (MiFID II). This advertising communication is not a recommendation or investment information recommending or proposing an investment strategy within the meaning of Regulation (EU) No 596/2014 on Market Abuse and Delegate Regulation (EU) 2016/958 under which Regulation (EU) No. 596/2014 has been completed, and is not included in the scope of investment advice included in the Securities Markets and Investment Services Act (Section 125.1g). This advertising communication has been prepared as diligently, transparently and objectively as possible, presenting facts known to the author at the time of its creation and is exempt from any element of analysis. This marketing communication has been prepared without regard to the client’s needs or individual financial situation, and does not constitute any investment strategy or recommendation. In the event that the advertising communication contains information about the performance or behavior of the financial instrument to which it refers, this does not constitute any guarantee or prediction of future results. Past performance is not necessarily indicative of future results and anyone acting on such information does so at their own risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

“Beeraholic. Friend of animals everywhere. Evil web scholar. Zombie maven.”

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/3FK4NB2IUBDNLGMO42HMXAA4JY.jpg)

:quality(75)/cloudfront-us-east-1.images.arcpublishing.com/elcomercio/Y5SIZUFLEBBRFC6B5SA4DT4R6I.jpg)

More Stories

BSE Sensex 30 Index: The Indian stock market opened with gains on May 6

Rank Schrontz, CEO of Boeing, dies at the age of 92

Why OpenAI CEO Sam Altman thinks the era of remote work is over