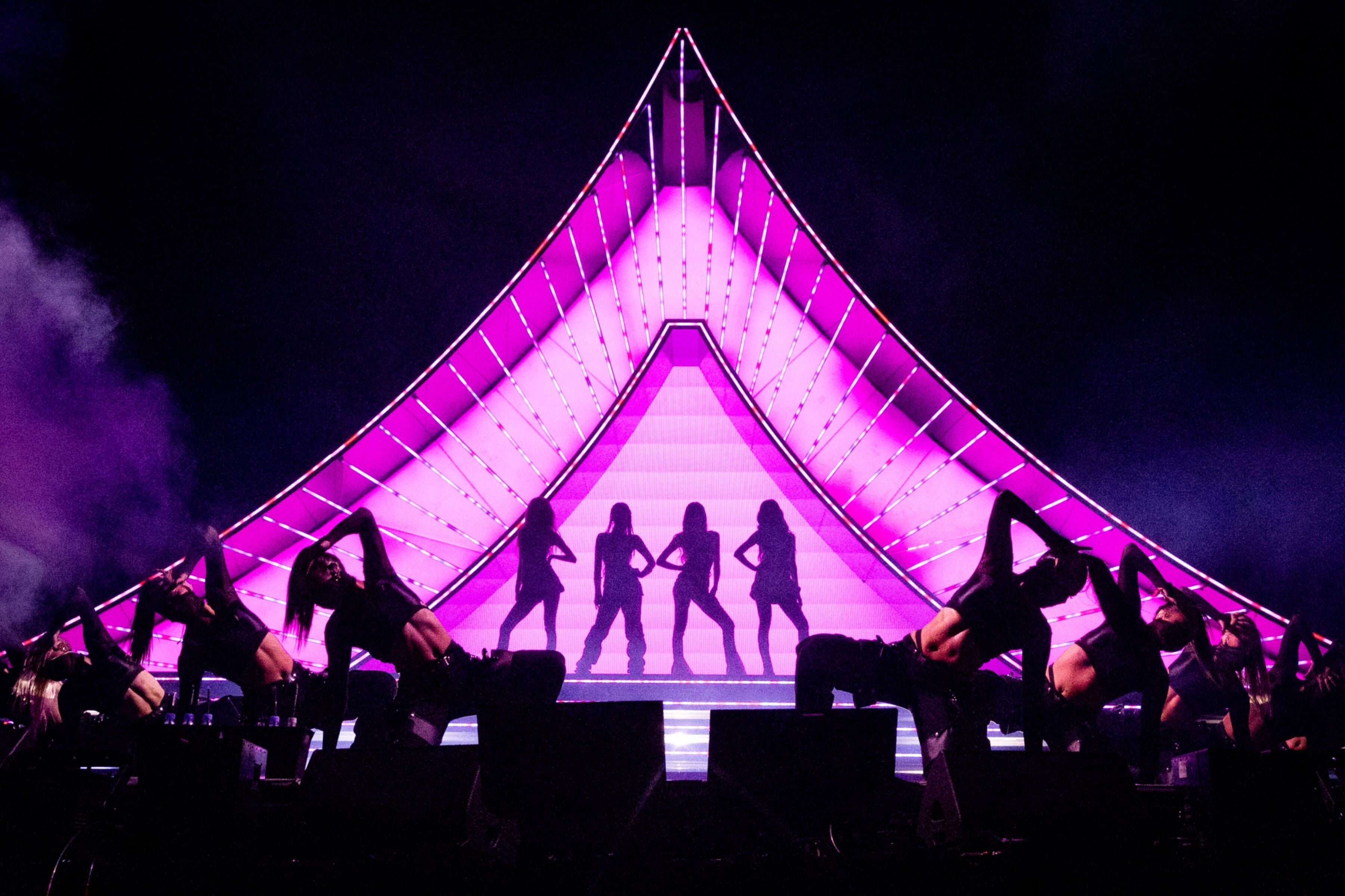

bloomberg – It seems that the $5.4 billion rise in K-pop stocks is on the way upwhile the increase in the number of fans around the planet is fueling one of the sharpest bullish runs in South Korean stocks.

This year, the share price of the country’s 4 largest K-pop companies (Hybe Co (352820), SM Entertainment Co (041510), YG Entertainment Inc (122870), and JYP Entertainment Corp (035900) has reached 100,000 shares). by at least 33%Double the rise of the Kospi benchmark. Some foreign funds are buying these shares because they are outperforming other global record companies such as Universal Music Group NV and Warner Music Group Corp (WMG).

From the group BTS to Blackpink, he has risen The lightning rise of these South Korean pop groups Investors’ curiosity aroused in a market in need of investment ideas. Goldman Sachs Group (GS) and Several operators have raised their reference prices over the past monthwhich placed the segment among the best options, as well as values related to EV batteries.

“Every week six new talents and groups appear in the music sector,” he explains. Jangwon Lee, which set up an exchange-traded fund to track stocks in the local entertainment industry. “It’s on its way to being something that will last longer. That’s why we’re looking at the rise of K-pop, Korean values for the entertainment world.”

Among the biggest K-pop agencies, YG Entertainment is up more than 100% this year and hit an all-time high this week. JYP Entertainment jumped 90%, while SM Entertainment jumped 33%.

Goldman raised its price target on JYP to 130,000 won ($98) from 97,000 won in May, maintaining a buy recommendation. Likewise, many domestic brokerage firms upgraded Hybe, YG, and SM after the companies reported first-quarter earnings, while Netflix has pledged to invest $2.5 billion in Korean content over the next four years..

Sanford C Bernstein Ltd. Hybe as their first choice in light of the company’s “advanced business structure”, with a The target price means a gain of 30% from the current level. Shares are up more than 50% this year despite the company’s failed attempt to gain control of smaller rival SM and worries about prospects after mainstay BTS took a career break.

her orgasm extend further off the coast of South Korea. While global funds sold $1.2 billion net worth of Kosdaq-listed shares this year, they bought $477 million worth of three K-pop stocks. The Kospi-listed Hybe attracted $245 million in net income, helping push the record-breaking bar to the brink of a bull market.

Get the benefits

But signs of tension appear amidst all the hustle and bustle.

Hybe fell as much as 5.1% on Friday after Bloomberg reported its plan to raise $380 million for more deals. SM Entertainment ended flat after posting its biggest drop in two months the previous day. The losses were fueled by the announcement that members of one of his most popular bands had attempted to terminate his exclusive contracts.

the Valuations are also becoming more expensive After the recent rally: Hybe has been trading at around 45x forward P/E since mid-October. JYP has been listed almost 33 times, which is more than a third higher than in the same time period. Meanwhile, Universal Music is trading near a seven-month low.

However, die-hard fans are unlikely to be deterred, as they hope the resumption of live concerts and Beijing’s openness to foreign entertainment will fuel growth.

Now that the world’s second largest economy has moved on from the days of the pandemic era, K-pop fans are now They will be able to travel to meet their idols and buy more albumsLee Hwajung, an analyst at NH Investment & Securities Co., said:

Analysts at Sanford C Bernstein, including Bokyung Suh, wrote in a recent note that the segment “will register a strong market growth trajectory at a compound annual growth rate of 12% in 2022-28 through stronger global market presence and monetization efforts by K-pop producers.” “.

With the help of Subrat Patnaik.

Read more at Bloomberg.com

“Travel junkie. Coffee lover. Incurable social media evangelist. Zombie maven.”

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/7RZ4PSPCSVHX5PY7Y7A4F2P2SE.jpg)

More Stories

Antonia Jones debuted with “vulnerable and honest” lyrics.

The most watched series on Disney+ Uruguay to spend hours in front of the screen

Ian Armitage, “Little Sheldon,” and his friend talk about the end of the series and its cancellation