Volatility in fixed income

/ After the rise of the last months of the year, 2024 begins with certain corrections, with fluctuations In line with doubts about ambitious (or not…) price cuts. We see how correct this correction is Of internal interest rates, which do not affect the visibility of the asset, and which appear to be nothing more than an ex post adjustment Best quarter for fixed income since 1990. While some experts like Bill Gross view longer-term levels as unattractive, some Fed members declare they are comfortable with them, although they do not expect interest rate cuts until the third quarter of 2024 conditional on continued low inflation.

/ What can we expect this year? According to the managers, the returns are very similar to the internal rates of return in the portfolio. We remember the target ranges for 2024 for the main government references: 4-5% for the Treasury and 2.25-2.75% for the package.

Variable income markets. The rise continued in December

/ After rising in November, indices were testing the resistance area at the July highs.

/ The joy in stocks continued: The Fed called a pause at its November 2 meeting; Analysts maintain a soft landing view; Market consensus has begun to advance the date of the next interest rate cuts. At the beginning of December, the market had already discounted 5 interest rate cuts in 2024.

Two ranges for the Eurodollar

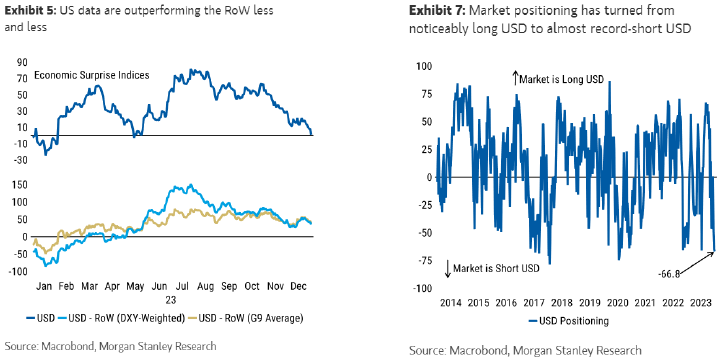

/ Tactical for short-term management 1.05-1.15. Other strategy, 0.9-1.10. Combining the two, current levels, near 1.10, look interesting for long-term position building, with the understanding that the expected improvement in Europe's relative momentum may cause the Euro to continue to rise somewhat in the short term. The dollar, which is currently short in the marketThis could find momentum in a correction to potential optimism in expectations for interest rate cuts (Fed minutes with no sign of cuts starting for March), or in periods of increased risk aversion.

“Beeraholic. Friend of animals everywhere. Evil web scholar. Zombie maven.”

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/5HTDSHIH5BDTZLUGYVDHX6BU3Y.jpg)

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/VDBB64DKPNCZ3FYGPCB2P6UKOY.png)

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/3DRCMMPANVGFRDILCJVDFLVJOA.png)

More Stories

China describes Tesla as an example of success between China and the United States

Room Mate will collaborate with two major international hotel companies

Chipazo lottery results: Who are the new millionaires?