The story behind the Argentine company that will take control of DirecTV Latin America: Werthein Holding’s business in various industries and its role in the field

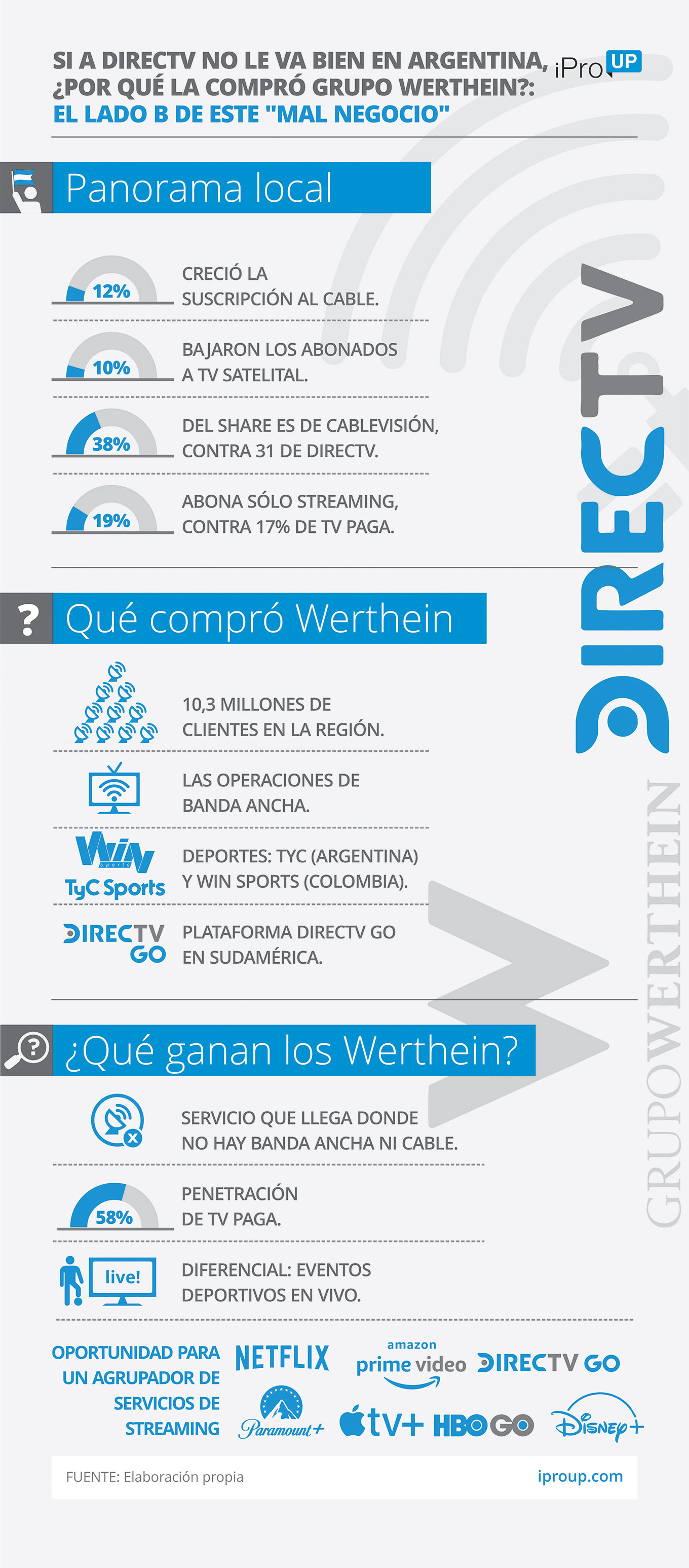

At the end of July, an Argentine group broke into the telecom world by announcing its purchase Free, Business Entertainment Unit in AT&T, who manages the brands for DirecTV GoAnd DirecTV Latin America And Sky Brazil.

At the time, it was the largest contributor to a trans-Andean conglomerate, Darius WerthenThe idea, he said, was to strengthen brands, maintain market position, and grow in the value proposition by investing in technology and content.

The announcement was surprising because the holding power, for nearly 100 years since its founding – in 1928 – has been associated with the management of the agricultural livestock industry.

In this case, one might think about how a company of this type would develop “technology and content” for television.

But, reviewing their history, the Wertheins had already tried their luck in these works. In fact, in the field of communications, the group became even more important when it bought a part Argentina Telecom, when I landed in that country in 1990.

And although it dumped that engagement in 2017 — after 14 years and a $3.3 billion debt restructuring — it hasn’t left the sector entirely. In the same year, he entered into a partnership with him Seaborn Networks To build a submarine cable linking Argentina with Brazil will require an investment of US$70 million.

Dario, Adrian and Daniel Werthen

This exchange will go to Kelp -1The submarine cable that connects today São Paulo to New York and will extend from the Brazilian city to Buenos Aires. But this network is not yet operational and it is not known what state of its construction will be.

Industry analysts estimated that precisely this development would boost both the broadcast television and broadcast business that DirecTV Go now represents.

In this, it is perhaps the reason for its return to the TV market that allows it to internationalize its business in this field, by managing a base of more than 10 million customers in the 11 countries in which the AT&T division operates so far.

Challenges

This isn’t the first time the group has made headlines for big betting. Passing it through the background Citicorp Equity Investments (CEI), by Argentina Provident and Insurance Fund Are just some of the companies in his career.

But the purchase of Vrio will be the family’s largest investment in terms of its regional reach and the initial amount committed to the operation. Which is that it would be about US$500 million, according to Bloomberg’s calculations, for a sealed operation in New York that is due to be completed in 2022.

Meanwhile, one of the Werthein family’s first challenges is to stop the drop in subscribers that Vrio has experienced.

Other business

“More than 100 years of work. 100% Argentine capitals”. The phrase used in the corporate presentation documents of the Werthein Group that well identifies a holding company that is currently simultaneously operating in sectors such as agriculture, mass consumption, financial, insurance, energy, wineries and even real estate.

They passed through the state power company YPF in the thirties. for him National Bank in the forties; Imported and distributed trucks strongholdIn addition to being a dealer for the same auto maker. Thus, dozens of other items.

The first steps were taken in the agricultural sector and expansion began in 1963, when the company jumped into the financial sector by acquiring Argentine Commercial Bank. In 1970 he made another leap by buying Argentine clothing industries (VAT), which at that time was the largest wool factory in the country.

Already in the 90s, it boosted its growth: it acquired 9.11% of the CEI investment fund, which it opened for participation in various industries.

Source: Diario Financiero-RIPE

“Beeraholic. Friend of animals everywhere. Evil web scholar. Zombie maven.”