The Reserve Bank of Australia (RBA) is set to announce its next monetary policy decision during the upcoming Asia-Pacific session (Tuesday, 3:30 AM GMT). The bank kept interest rates unchanged at the previous four meetings, but the market consensus now expects them to increase!

What to know before the RBA interest rate decision?

- Key interest rates: 4.10%

- Rates were last changed in June 2023 (+25 basis points)

- The 400 basis points of adjustment is effective from April 2022

- The Reserve Bank of Australia expects inflation to fall below 3% in the fourth quarter of 2025

- Q3 CPI at 5.4% y/y (expected 5.3% y/y, previous 6.0% y/y) and 1.2% q/q (expected 1.1% q/q, previous 0.8% q/q) )

- Q3 PPI was 3.8% y/y (previously 3.9% y/y) and 1.8% q/q (previously 0.5% q/q)

- Change of job in September: +6.7k (experience +20k, previous +63.3k)

- Unemployment rate in September: 3.6% compared to 3.7% in August

- September Retail Sales: 0.9% mo (expected 0.3% mo, previous 0.3% mo)

- September services and manufacturing PMI below 50 points.

- New Home Sales in September: -4.6% m/m (expected 1.1% m/m, previous 8.1% m/m)

The Reserve Bank of Australia expects to raise interest rates by 25 basis points

The average consensus among economists and financial institutions is that the Reserve Bank of Australia will raise interest rates by 25 basis points after remaining unchanged for almost half a year. The latest inflation data for the third quarter of 2023 beat expectations and price growth compared to the second quarter accelerated quarter after quarter. The labor market remains tight and retail sales data suggests consumer spending remains strong. The reasons for a rate hike are there, and recent hawkish comments from RBA members are a strong signal that it could happen.

However, this will likely be the last. Despite the fairly strong outlook for the Australian economy, financial markets are pricing in a slightly better than 50% chance of a 25 basis point rate hike and no further increases after that. The first interest rate cuts are priced in the second half of 2024.

Financial markets expect a 56% probability that the Reserve Bank of Australia will raise interest rates by 25 basis points tomorrow. Source: Bloomberg Finance LP

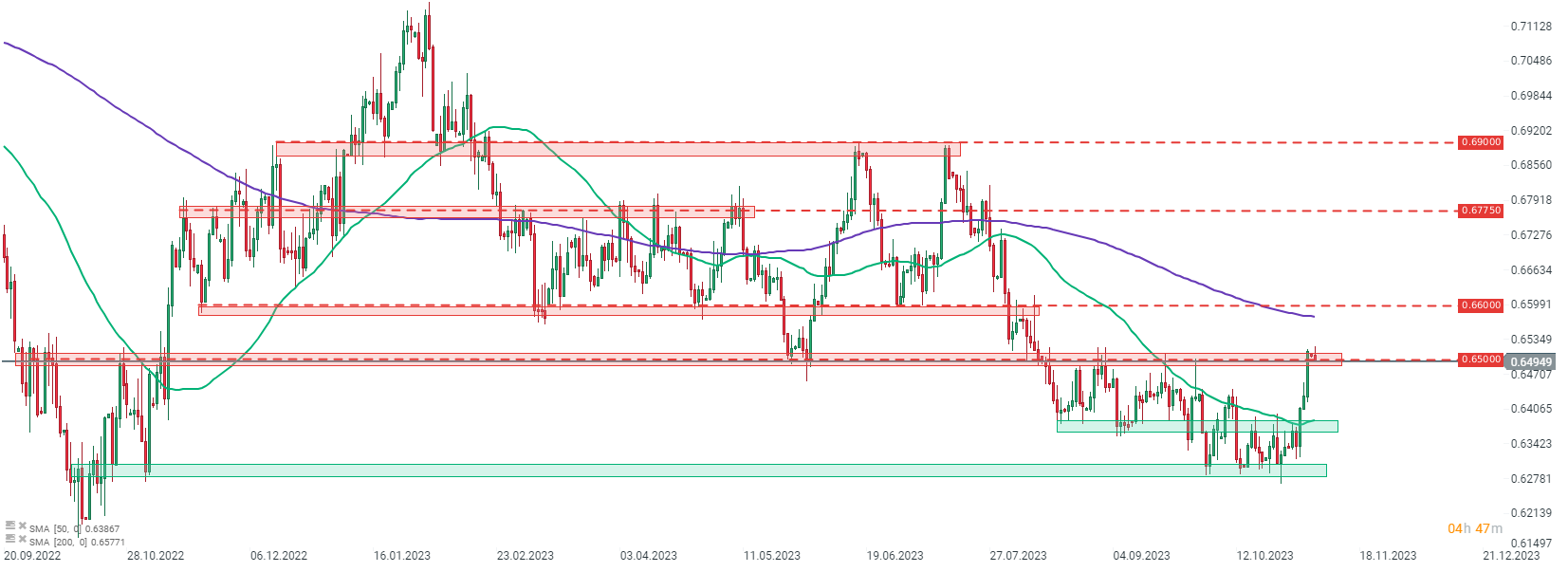

A look at the Australian dollar versus the US dollar

The AUDUSD has been trading higher recently, partly due to a weaker US dollar and better performance of Antipodean currencies. The pair has rebounded from one-year lows and is now testing the resistance area around the 0.6500 level, the highest level since early August and September 2023. While economists expect a 25 basis points rate hike, the market is setting 60% for a surprise. . The fact that the rally has not been fully priced in also means that the Australian dollar could rise if the forecast comes true. If we see a break above the 0.6500 resistance area, the next level to watch could be found at the 0.6600 area.

“This report is provided for general information and educational purposes only. Any opinion, analysis, price or other content does not constitute investment advice or recommendation under Belize law. Past performance is not necessarily indicative of future results, and any person acting on such information shall XTB does so at its own risk. XTB will not accept liability for any loss or damage, including, without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.”) Leveraged products carry a high level of risk. Please ensure you understand the risks associated.”

“Beeraholic. Friend of animals everywhere. Evil web scholar. Zombie maven.”