Stablecoins are the cornerstone of the digital asset market, with a market capitalization of $100 billion. What do they need to grow?

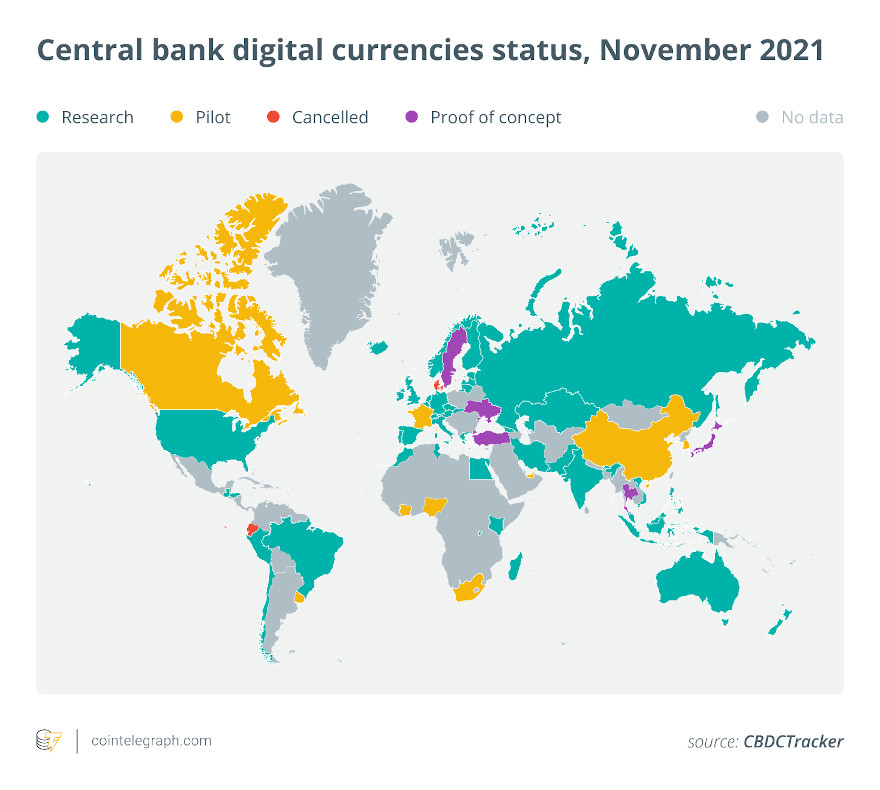

Governments are already devoting significant resources to keeping pace with trends. November 2021 report published by United States President’s Task Force The financial markets detail various measures to ensure financial regulation stablecoins It is applied within government guidelines. A global survey of central banks conducted by Bank for International Settlements (BIS) shows that 86% of central banks are now actively operating in some way Central bank digital currencies (CBDC), a form of government-backed stablecoin. Of this group of central banks, seven have officially launched central bank digital currencies, while another 17 are in the beta phase, according to the Atlantic Council’s CBDC tracker.

Like all cryptocurrencies, stablecoins are based on blockchain technology (blockchain) to support peer-to-peer (P2P) digital transactions, giving them the characteristics of a bearer tool and the ultimate settlement of cash. This core decentralized infrastructure promises faster transactions, lower settlement costs, greater transparency, and greater control for end users.

Several market players, both public and private, have developed multiple fragmented blockchain networks. For stablecoins to be fully beneficial, several of them must be traded. Nowadays, innovative stablecoin developers like Day (DAI), TerraUSD (UST) y USD . coin (USDC) faces undue costs and security risks by building point bridges to achieve this. For the market to grow and innovate further, there is a need for a global interoperability network that securely connects all blockchain networks. These global interoperability solutions will also help CBDC and stablecoin developers overcome the costs and security risks associated with point building.

Stablecoins are the cornerstone of the digital asset market, with a market capitalization of $100 billion

Stablecoins are the cornerstone of the digital asset market, with a market capitalization of $100 billion

The need for interoperability between blockchains

Digital assets cannot reach their potential by operating on isolated networks and stablecoins are no different. Interoperable design solutions will enable stable assets to play a critical role in the economic transformation of many countries by optimizing costs, time, and management associated with cross-border transactions, transfers, and even supply chain management. Interoperability solutions can facilitate the deployment of digital assets, across blockchain networks and between specific CBDCs, notes Cointelegraph.

USDCOne of the most dominant stablecoins in the market, gives us a good example of the need for interoperability between blockchains. After the USDC was initially published in Ethereum, the center consortium, USDC developers, had to rebuild the USDC stack on other blockchain networks like Solana And AlgorandAmong other things, to respond to the growing market demand for applications in these networks. By building these stacks, the USDC developers have been addressing the real issues and shortcomings: various technology stacks are fragmenting the liquidity of your stablecoin.

A single network of interoperability between different block chains can make this happen decentralized applications (DApps) and assets are available to the entire blockchain ecosystem without the need to redeploy software packages on each new blockchain network. This will help reduce the demand pressure on developer resources at the protocol and application level.

The interoperability From the blockchain, stable transactions, including payment transfers and staking, can be carried out between issuers of stablecoins and owners of different blockchain networks. This type of solution will greatly enhance liquidity and ensure greater compatibility in the $100 billion stablecoin market. This will also eliminate the need for stablecoin issuers to go through the cumbersome process of listing their stablecoins separately on each blockchain network, as they currently do.

CBDCs also require interoperability. The July 2021 BIS Report highlights the need for multilateral cooperation and the need for network interoperability between CBDCs. While some governments will want to pursue protectionist policies, interoperability will benefit those who take a more open approach, facilitating international transactions involving digital central bank currencies, including cross-border trade flows, international remittances, and cross-border transactions. These benefits may be part of the reason why the Banque de France partnered with the Central Bank of Tunisia in the seventh CBDC trial for France. On the occasion of the launch of the Nigerian digital currency, nayiraThe Governor of the Central Bank of Nigeria has highlighted the advantages of his new digital currency operating within an interoperable framework.

86% of central banks are now actively working in some way with central bank digital currencies

86% of central banks are now actively working in some way with central bank digital currencies

Security and decentralization are at the heart of interoperable designs

The developer’s efforts, outlined above, on the world’s largest stablecoins illustrate the need for interoperability. It also highlights the risks and costs of building custom solutions in a world that does not yet have a global interoperability protocol. Due to the complex requirements of interconnecting different blockchain networks, inter-chain interoperability adds additional security considerations. Exposure to multiple blockchains opens these networks to more potential attack vectors. The world witnessed a devastating example of this in August, when an attacker drained more than $600 million worth of cryptocurrency. poly meshThe interoperability bridge used in decentralized finance applications (DeFi).

Any blockchain network that claims to deploy interoperability solutions must be built to ensure the highest security standards in the industry, but at the same time not affect its responsiveness, efficiency or decentralization. Multilateral encryption and decentralized consensus are key components that allow developers to build robust, scalable, and interoperable systems. The combination of these initial elements enables the creation of decentralized interoperability protocols that can securely protect cross-chain transactions and remain secure in the presence of multiple malicious participants.

Blockchain interoperability will open up new economic opportunities

As the launch of CBDC pilot projects accelerates and stablecoin growth continues, global trade bodies, technologists, blockchain developers, and payments providers will continue the development and success of CBDC programs and stablecoin projects. They are looking for a way for these innovations to introduce new processes into the national and international payments landscape. The benefits of a global framework for stablecoin interoperability will increase the scalability of international payment transactions between countries, thus facilitating more efficient and improved cross-border trade flows, faster settlement of international remittances, and increased financial inclusion through digital devices such as smartphones. The digital economic developments deriving from this system will contribute to enhancing the economic GDP of many countries.

For societies and economies to fully benefit from digital central bank currencies, comprehensive interoperability will be essential to support integration and interoperability across the international payments system. Similarly, stablecoins issued on different blockchain networks can only successfully facilitate digital payments if they can be accepted globally on different blockchain networks. The global interoperability network in which central bank currencies and stablecoins can operate effectively will unlock further economic and commercial benefits for end users, businesses and governments alike.

“Beeraholic. Friend of animals everywhere. Evil web scholar. Zombie maven.”