Today in this article we are going to update how debt is growing at 18.64% in the health sector, for this we will take two sources: the first is the Superhealth Portfolio Monitor and the second is the 8 days ago updated report by ACHC.

Portfolio Observatory, December 2021

The first number that surprises (and hurts) us is the general observatory figure which shows 45.18 billion dollars in accounts payable by the creditor, of which 33.34% correspond to IPS private services and 32.24% are not identified …

When we put a magnifying glass on debtors and determine a percentage of the value of these historical liabilities, we find the following:

New EPS appears to top this ranking (it makes sense because it is the largest health-promoting company and concentrates the largest operational and financial risks), with 25% debt.

They are followed by fiduprevisora (teachers) at 8%, Saludcoop EPS with 7% and Medimás at 5%, and Sanitas and Salud Total with the same 5%.

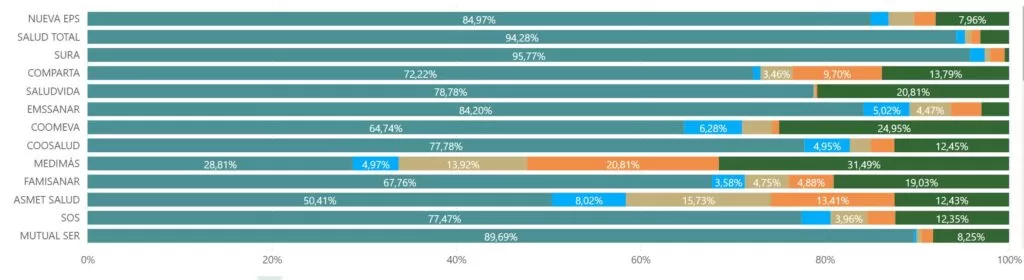

But these raw numbers must be contrasted with the age and lag in those accounts receivable, which lightens their weight, as we see below:

To look at the EPS of the backed company, its breakdown is as follows: Emssanar 84% of its current portfolio, Coosalud 78%, Mutual Ser 90% and even Asmet Salud with only 50% and Capital Salud with 52% is your current portfolio.

EPS liquidated with Coomeva at 65% and Medimás at 29%.

EPS . Accounts Receivable

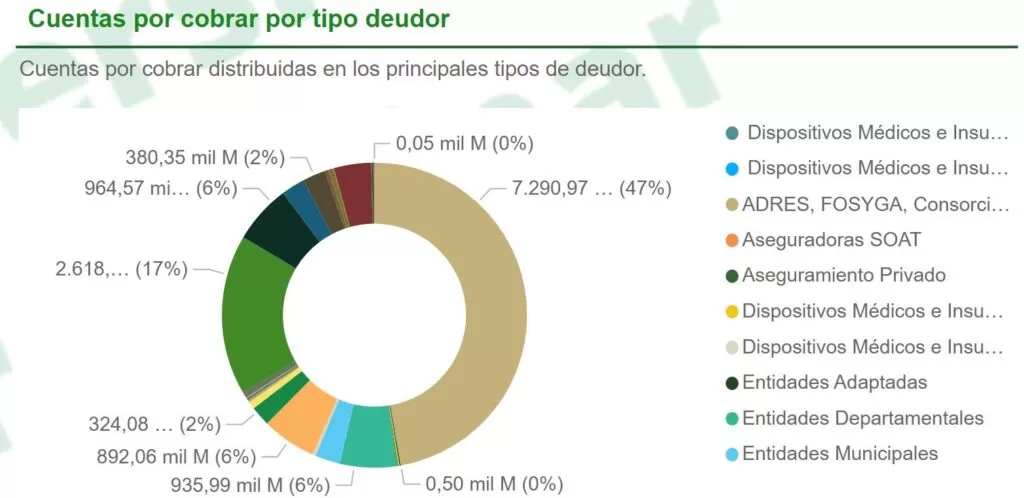

Of course, EPS also owes money, not just an end point. Let’s see how it goes.

As of December 31, 2021, the numbers are as follows:

The largest EPS debtors are, in order: $7.2 billion, $2.6 billion from IPS Special Services, $964 billion IPS, and $935 billion in administrative entities.

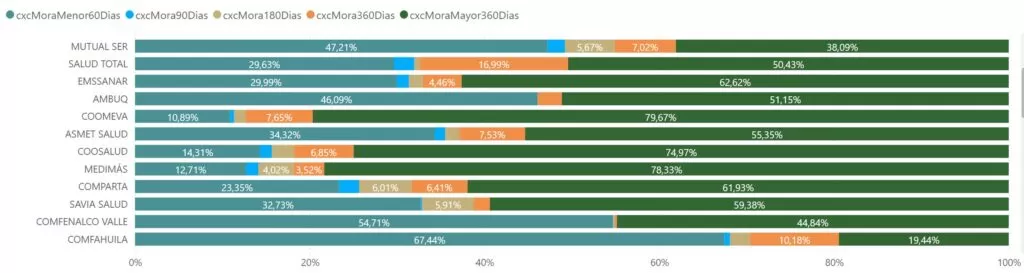

The age and arrears of EPS accounts receivable are not benign, and obviously should affect their regular operation:

Total debt per subsidiary as of December 2021

This year-long follow-up reflects an intractable truth: the race continues to grow and threatens the sustainability of the system:

The portfolio grew unequivocally in the previous year by 18.64% per member of the health system, far more than the UPC and inflation.

ACHC Hospital Portfolio Monitoring Report

Very kindly, Dr. Juan Carlos Giraldo, Director General of the Colombian Association of Hospitals and Clinics (who once again implemented the Meditech program with great success) and Juan Guillermo Cuadros (a member of the ACHC Research Group) sent us their 47th report.

To interpret this study that aligns with your union, it is necessary to note that ACHC’s 47 portfolio study has a total of 207 clinics and hospitals to report.

Hospital organizations have allocated in their “delayed accounts” more than $2.8 trillion (more difficult to collect the portfolio), which is 22.4% of the total debt as of December 2021 without impairment (more than approximately $12.7 trillion); That is, for this period, the composition of the hospital portfolio of the group of 207 institutions is as follows:

Current and non-accrual portfolio: 43.1%

Overdue portfolio (more than 60 days): 34.5%

Overdue portfolio designated for impairment under IFRS methodology (more challenging portfolio

Collection): 22.4%

▪ Total portfolio (total of previous categories): 100.0%

Total portfolio of 207 IPS by ACHC

The total and real value of the portfolio for the sale of health services (not including age-delayed portfolio deterioration) for the group of 207 institutions that provided information in this reduction, is twelve billion seven hundred forty-nine thousand (more than 12.7 billion pesos) and the late portfolio concentration (more than 60 days) at 56.9% (about $7.3 billion).

If “age-delayed portfolio impairment” were included, as ordered by the IFRS methodology, the value of accounts receivable as of December 2021 for the 207 hospitals and clinics would be approximately 9.9 billion pesos. Late portfolio concentration of 45.5% ($4.5 billion).

Regardless of the two scenarios described, it should be noted that this study presents an increase in the absolute and relative amount of the total portfolio and arrears owed to reporting clinics and hospitals, compared to all previous reductions, after reactivation in the provision of services and after the start of the national government’s declaration of mandatory preventive isolation and a state of economic and social emergency And environmental, prompted by the global pandemic of COVID-19, where most procedures and face-saving have had to defer, defer or provide direct health services through the method of telehealth, telemedicine or home care.

Regarding the portfolio ratio by ages compared to the semester up to June 2021, it was noted

Discount through December 2021 for the latest 30-day portfolio (37.1% vs. 38.3%) and

Increase in portfolio engagement over 90 days (51.8% vs. 51.3% in the period to June)

from 2021). The average range from 31 to 90 days also shows an increase of up to

11.1% versus 10.4% last semester.

Download

Report No. 47 on ACHC Hospital Portfolio Monitoring

“Beeraholic. Friend of animals everywhere. Evil web scholar. Zombie maven.”