In the final weeks of 2021, Europe’s spot and futures electricity markets continued to break price records, in a context where gas and carbon dioxide prices also hit record highs.2 still high. New nuclear shutdowns announced in France added more uncertainty to the situation, and an overall drop in wind power production in the third week of December exacerbated expectations.

Solar photovoltaic, solar thermal and wind energy production

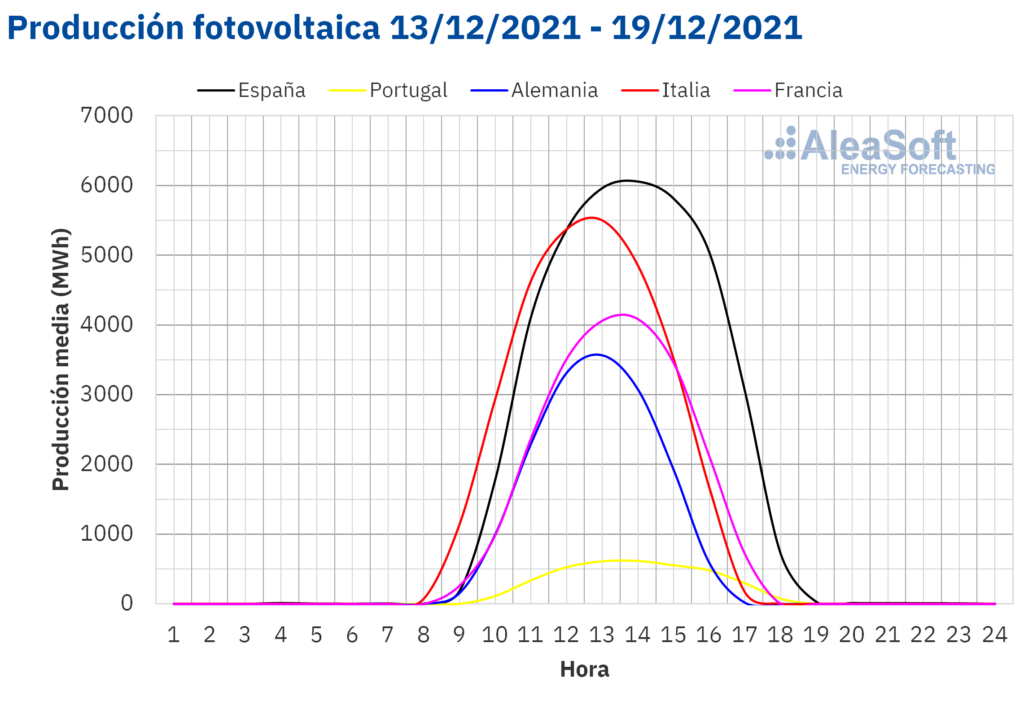

In the week of December 13 solar energy production It rose compared to the week of December 6 in most European markets. The highest increase in percentage terms, 60%, was recorded in the French market, followed by the Portugal and Italy markets where production increased by 44% in each case. In mainland Spain the entire production PV s Thermal by 17%. However, solar energy production in the German market fell by 15%.

according to Solar production forecast AleaSoft Energy ForecastIn the week of December 20, production with this technology is expected to recover in Germany and decline for a week in the markets of Spain and Italy.

Source: Prepared by AleaSoft Energy Forecasting with data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting with data from ENTSO-E, RTE, REN, REE and TERNA.

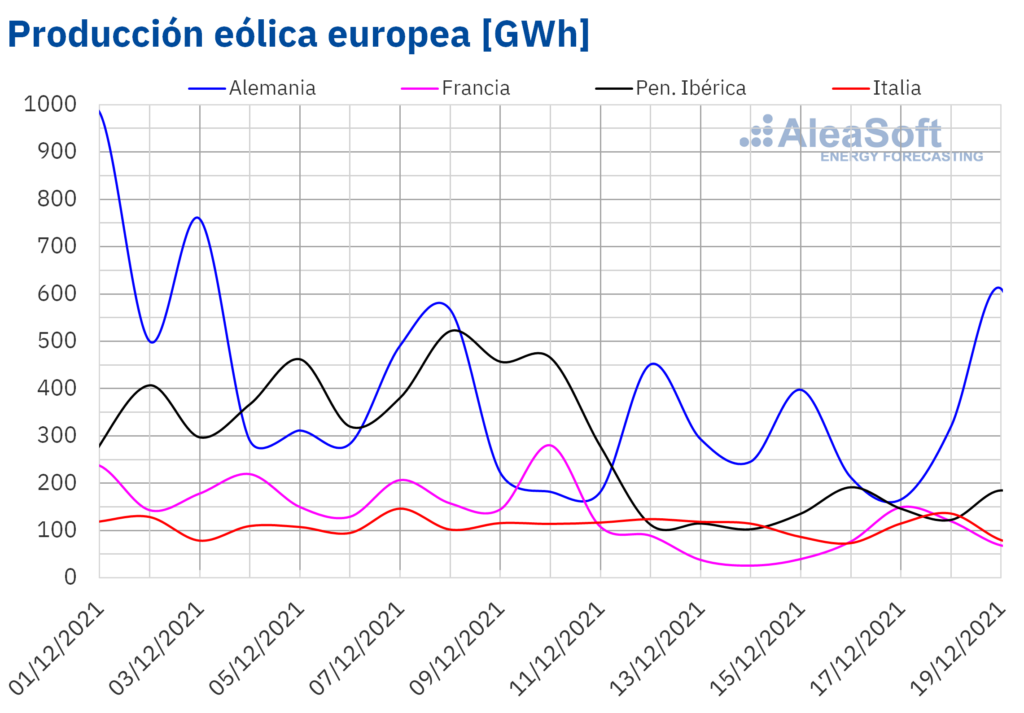

in case if wind production, in the week of December 13 there was a general decrease compared to the previous week in all European markets analyzed in AleaSoft Energy Forecast. The declines were between 5.6% from the German market and 66% from the Spanish market.

In the penultimate week of the month, production with this technology is expected to increase compared to the previous week in the markets of Germany, France and Spain, while it will decrease again in Portugal and Italy, according to wind production forecast AleaSoft Energy Forecast.

Electricity demand

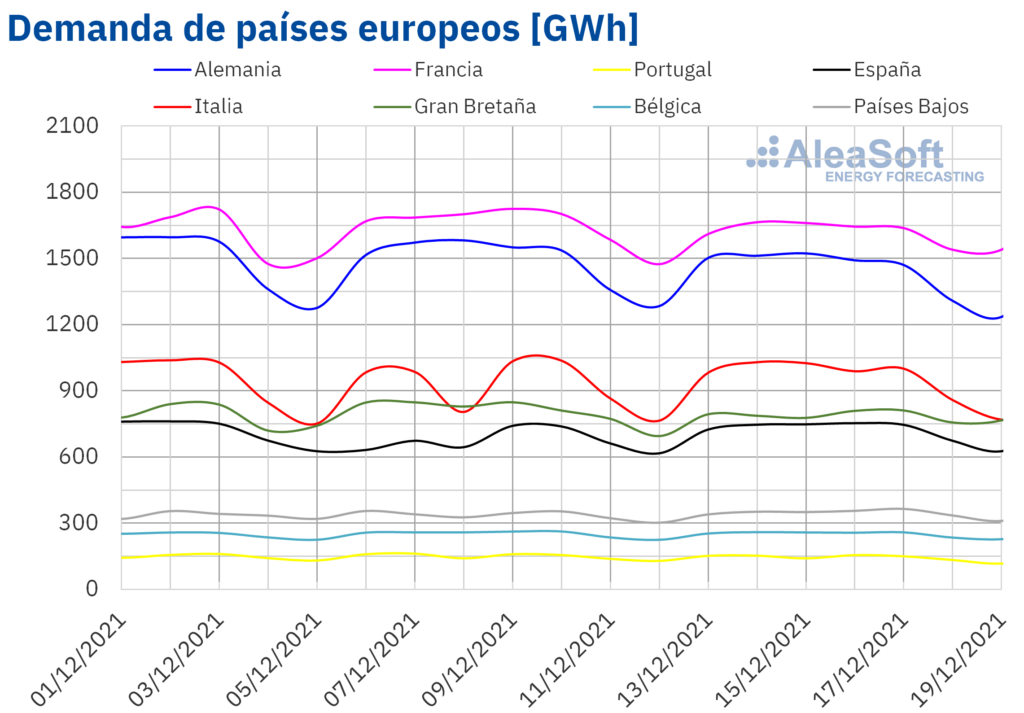

the Electricity demand It decreased in most European electricity markets during the week of December 13th, compared to the previous week. The main reason for these declines was an increase in average temperatures in most markets, which rose to 4.1°C in Germany. The drop in demand was less than 5.0% in all markets that experienced a decline, with the most significant differences recorded in Portugal and Germany, which were 4.3% and 3.4%, respectively. On the other hand, demand in the Spanish market increased by 6.6%, and in Italy by 2.8%.

Electricity demand forecast from AleaSoft Energy Forecast They indicate that average temperatures will decrease in most markets and that there will be lower demand in Spain, Germany and Italy.

European electricity markets

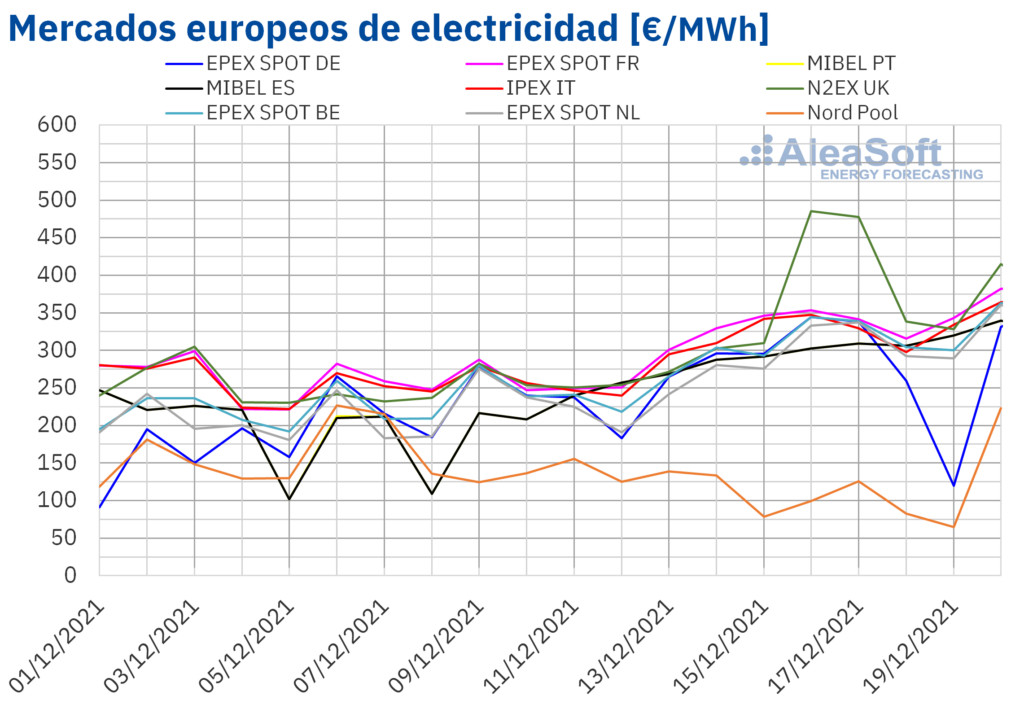

In the week of December 13, the prices of almost all European electricity markets were analyzed AleaSoft Energy Forecast More than the previous week. was the exception Mercado Nord Pool From the Nordic countries, with a 36% decrease in prices. On the other hand, the biggest increases were those MIBEL . Market from Spain and N2EX Market From the UK, 44% in both cases, followed by a 43% increase in the MIBEL market in Portugal. On the other hand, the lowest price increase was EPEX SPOT سوق Market From Germany 20%. In the rest of the markets, price increases were between 26% of IPEX Market from Italy and 33% of the EPEX SPOT market in the Netherlands.

In the third week of December, almost all analyzed markets reached average weekly prices above €270/MWh. The exception was the Nord Pole market, which recorded the lowest average, €103.15/MWh. On the other hand, the highest average weekly price of €359.18/MWh was that of the N2EX market. In the rest of the markets, prices ranged between €273.90/MWh in the German market and €332.79/MWh in the French market.

In terms of daily prices, the highest price of the week was reached at €485.20/MWh on Thursday, December 16 in the British market. On the other hand, the lowest daily price for the week, €64.47/MWh, was recorded on the Nord Pole market on Sunday, December 19. On the other hand, in the markets of Spain and Portugal, records of maximum prices were reached on Monday, December 20, and in the markets of Germany, Belgium, France, Italy and the Netherlands on Tuesday, December 21.

These daily price records also fetched hourly price records. This is the case of the Spanish and Portuguese electricity markets, which hit a record price of €375.00/MWh between 8:00 pm and 9:00 pm, on Monday 20. In addition, fifteen of the nineteen most expensive hours in history are from the market Iberia as of Monday 20 December.

Tuesday 21 prices were also record, which was reached in the Italian market between 6 pm and 7 pm, € 508.44 / MWh, and in the Dutch market between 5 pm and 6 pm, € 620 00 / MWh.

During the week of December 13, the general decline in wind energy production with rising gas prices, due to tensions with gas supplies from Russia, and rising carbon dioxide prices.2 Favored the high prices in European electricity markets. The French nuclear availability situation has also played a large role in the recent price hike.

Price forecast for AleaSoft Energy Forecast It indicates that in the week of December 20, prices may continue to rise in most European electricity markets, favored mainly by the random shutdown of nuclear reactors in France and the upward trend in gas prices. . However, there may be lower prices in the MIBEL market due to a significant increase in wind energy production in the Iberian Peninsula and an increase in average temperatures in Spain and Portugal.

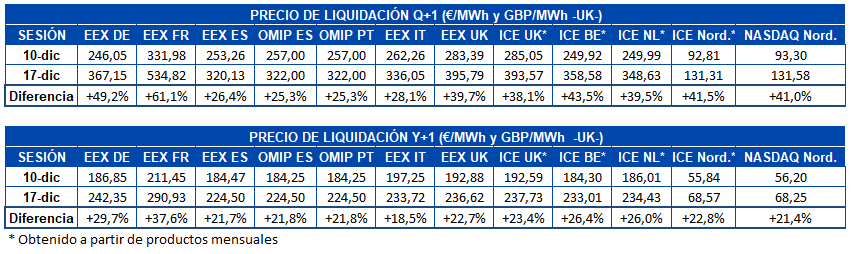

Electricity futures contracts

When comparing the market sessions of Friday, December 10 and Friday, December 17, a general rise in electricity futures prices for the next quarter was observed in all European markets analyzed in AleaSoft Energy Forecast. the EEX سوق Market France was the country with the highest increase of over 61%, and it ended on Friday, December 17 at a closing price of €534.82/MWh. On the other hand, the OMIP . market Spain and Portugal were the countries that recorded the least variance between these two dates, with an increase of more than 25% in both countries.

This surge in electricity futures for the first quarter of France is mainly due to the recent EDF announcement of the closure of two nuclear power plants in Chooz and Civaux. In an environment that was already tense, the shutdown of these reactors until spring is worrying, as these units account for 10% of nuclear generation capacity in a country where this technology is responsible for covering more than half of national demand.

Electricity futures prices for 2022 presented a similar behaviour, with increases for these products being between only 18%, the value recorded on the EEX market in Italy, and just under 38%, an increase for the EEX market in France. In absolute terms, the ice market from the Nordic countries and Nasdaq market Also from the same region, they were the lowest increase, with a difference of €12.73/MWh and €12.05/MWh, respectively.

Brent, fuel and carbon dioxide2

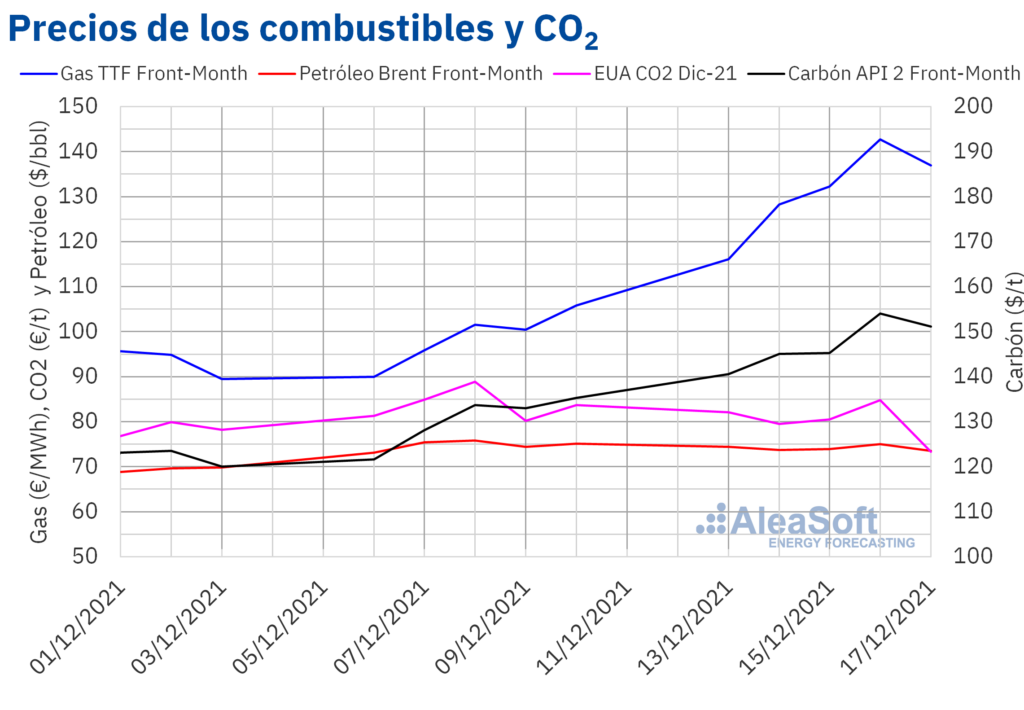

futures prices for Brent oil For the front – a month in ice market During the third week of December, they fluctuated around $74 a barrel. On Thursday, December 16, the maximum closing price for the week was reached, which is $75.02 per barrel, while the minimum closing price for the week, which is $73.52 per barrel, was on Friday, December 17. But, on Monday, December 20, those futures contracts were already trading at less than $73 a barrel.

Concern about the effects on demand from the expansion of the novel coronavirus variable continues to weigh on prices. The increased restrictions and restrictions imposed recently in some countries may have a bearish effect on prices in the coming days.

Regarding futures prices TTF gas In the ICE front-month market, during the third week of December, they increased until they reached a closing price of €142.76/MWh on Thursday, December 16th. That price was 42% higher than the previous Thursday and the highest in at least the past eight years. On Friday, December 17, prices fell by 4.1% to €136.91/MWh, but this price remained 29% higher than the previous Friday.

Regarding the future CO2 emissions rights2 in a EEX سوق Market For the reference contract in December 2021, during the third week of December, they remained below €85/ton. The lowest settlement price for the week, 73.28 € / ton, was recorded on Friday, 17 December. This price was 12% lower than the previous Friday. The proximity to the end of negotiations on this product encouraged lower prices.

Analysis of the prospects for energy markets in Europe and financing of renewable projects

The evolution of energy markets in Europe and their forecasts for 2022 will be analyzed in Next webinar organized by AleaSoft Energy Forecast, which will be the first in 2022 in their monthly webinar series. Periodic review of the electricity, gas and carbon dioxide markets2 On this occasion, oil will focus on its development during 2021 to understand what is expected for 2022.

The webinar, to be held on January 13 and for which invitations can already be requested, will be attended by speakers from PwC Spain that will contribute to their vision of the impact of the regulatory situation and the electricity market in Financing renewable energy projects and in the development of PPAs, off-site and on-site.

fountain: AleaSoft Energy Forecast.

Views after:

3

“Beeraholic. Friend of animals everywhere. Evil web scholar. Zombie maven.”

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/R5BNJX7RHGU5FSPXQJHMRLXVKE.jpg)

More Stories

Companies will continue to pay less dividends to the Treasury in 2023 than before the financial crisis

Closing value of the euro in Haiti on April 25 from EUR to HTG

This is an innovative olive oil designed to be mixed with any type of milk