Good evening! Arrival Line brings you the daily summary of closing markets

🗽 On the streets of Wall Street:.

US stocks returned to losses after Federal Reserve officials insisted that the central bank… Communicate with aggressive tone of its monetary policy Until they managed to control the highest inflation rate in decades.

St. Louis Federal Reserve Chairman James BullardDuring a press conference after participating in a virtual forum, he said that those responsible for monetary policy are “determined to reach the correct level of the monetary policy rate.” To exert significant downward pressure on inflation“.

During his speech at the forum, he suggested that Markets were now getting the message from the central bank. His aggressive stance was in line with Cleveland Federal Reserve Chair Loretta Meester, who said, during an interview with CNBC, Officials are intent on raising the standard price to a level considered restrictive.

All three major US stock indexes gave up gains on Wednesday, and in Thursday’s session the S&P 500 fell 2.11% and It hit a new low for the year with levels not seen since November 2020.

Cursor pulled down by Apple (AAPL)Which is down as much as 6.1% after a Bank of America analyst (buck) Bloomberg warned of weak consumer demand for its popular devices.

The Dow Jones Industrial Average lost 1.54%while the Nasdaq Composite Index (CCMPDL) He lost 2.84%.

“The market is now accepting the idea of that Recession is almost a given right now s It really is making adjustments for thatShaun Snyder, director of investment strategy at Citi US Wealth Management, told Bloomberg.

🔑 Keys of the day:

Fears of an economic slowdown once again weighed on oil prices Which is also down after the Wednesday session is up more than 3%.

decline in economic growth It will affect the demand for oildespite the market support for reports that OPEC + discusses the possibility of cutting crude oil production when it meets next week.

“The turmoil in the stock markets reduces the benefits of crude oil, as The appetite for risk fades quickly. The deteriorating prospects for demand for crude oil will not allow oil to rise until energy traders have confidence in it OPEC + will cut production at the October 5th meeting‘,” added Edward Moya, analyst at Oanda.

Although the two referrals are on track to make a weekly profit, Prices will end with their first quarterly loss in more than two years. The dollar’s strength during the month, which reached an all-time high, It made the commodities traded in that currency less attractive.

👑 leader:

The Colombian stock market rose and broke off from the declines of the United States and COLCAP Favorite Added for the second consecutive day of gains.

Terpel . Arrow (Terpil)ISA . group (he is) and Grupo Energía Bogotá (GEB) Led increases with the title Ecopetrol (Ecopetel)And the Who moves the most trading volume.

The company’s president, Felipe Payon, made it clear on Thursday that the government’s tax reform could be very harmful to the company, and therefore Provided an alternative that allows the industry to contribute financially without significantly affecting your accounts.

During the day, investors discussed the Republic Bank’s decision Increase the interest rate by 100 basis points. The reference rate increased from 9% to 10%. In search of addressing the price escalation that has occurred since 2021.

Central Bank Board of Directors It is estimated that the pace of economic activity remained dynamic in the second quarter. On this basis, the technical team raised the GDP growth forecast By 2022 from 6.9% to 7.8%.

📉 bad day:

Risk aversion has hit most Latin American stock markets, which again recorded a day of losses. IPSA in Chile (IPSA) The fall deepened and added two consecutive sessions with numbers in red.

SQM / B . shares (square meter/b)Enel Chile (ENELCHIL) and fumes (fumes) They were among the most affected by the contagion of international sentiment.

A report by Banchile Inversiones, reviewed by local media, lowered its IPSA forecast citing expectations of Further increases in interest rates and a fall in copper prices.

Ibovespa (IBOV) It also retreated, after the poor external environment and the fall of Petrobras (PETR3; PETR4), which has a large weight in the index and Lost in the midst of falling oil prices.

In Brazil, the market is also waiting for the last days before To the presidential elections scheduled for next Sunday.

S&P / BMV IPC for Mexico Favorite He didn’t shy away from red number losses in stocks like Volaris (will fly), gruma (gromap) Pacific Airport Group (jab).

We still suggest caution, as there can be no sustainable recovery in stock markets As long as the Fed continues its restrictive stanceActinver analysts wrote in a note.

During the day, the Bank of Mexico again followed in the footsteps of the United States Federal Reserve and Raise the target benchmark interest rate by 75 basis points to leave it at a historical level of 9.25%, the highest level since January 2008.

The truth about dinner:

Launch SoftBank Wednesday for about 18% -10 people – from his team at Vision Fund of Latin AmericaBloomberg told Line a person familiar with the matter preferred to remain anonymous because the discussions are private.

Globally, there were about 150 affected people in the Vision Fund, Just under 30% of the teamAccording to this person. The decision comes after the founder of the Japanese group, Masayoshi Son It announced a record loss of $23 billion in its latest report.

Today, SoftBank has just over 80 companies in its Latin American portfolio, Unicorns like Rappi, Creditas, Kavak, Vtex, Olist and Madeiraand is expected to announce new investments soon, said Rodrigo Costa, partner at SoftBank Investment Advisers, during an event organized by Demarest Advogados last week.

Searched by Bloomberg Line, SoftBank employees said they would not comment on the layoffs.

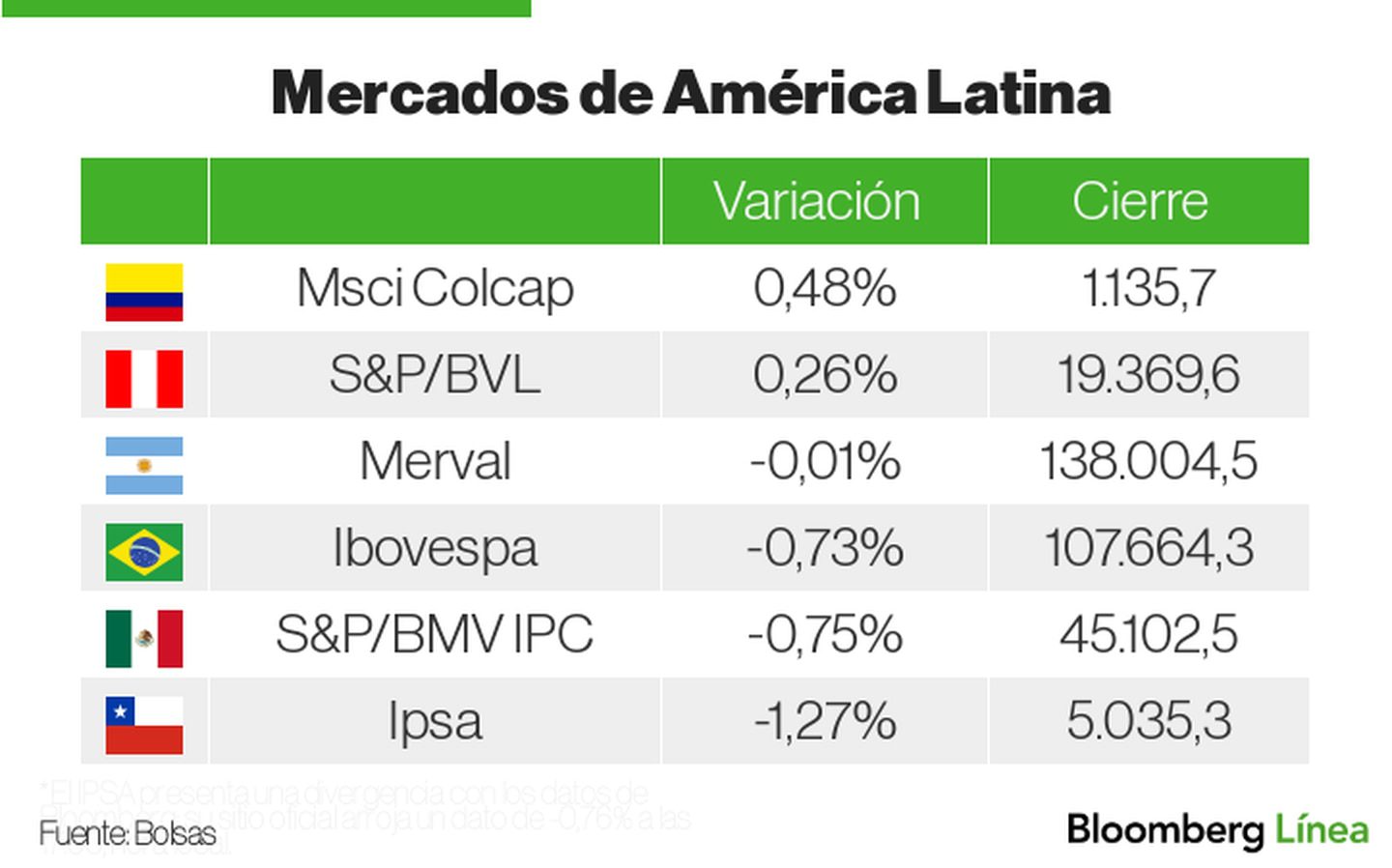

This is how Latin American markets behaved:

Argentina:

Brazil:

- Morgan Stanley, in a report published this week, said investors in Brazil should not fear a sharp deterioration in public accounts after the election. In the assessment of the US bank, regardless of the outcome of the surveys, the financial outlook is likely to get worse as spending limits are relaxed, But the effect should be modest.

Chili pepper:

Colombia:

- The Banco de la República board voted Thursday to raise interest rates to the highest level in the last 14 years and For the first time in that period it reached double digits. In a split resolution, a majority favored raising intervention rates by 100 basis points, while the minority voted by 50 basis points.

Mexico:

- Mexico gave Petróleos Mexicanos (Pemex) 45.4 billion Mexican pesos ($2.25 billion) to pay off its discounted debt in the second quarter, even as the state oil company boasted record profits and promised to pay off its debts. Pemex indicated that it has received support from the federal government to pay off the debt, in a presentation to investors published Thursday, September 29.

Peru:

Venezuela:

“Beeraholic. Friend of animals everywhere. Evil web scholar. Zombie maven.”

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/UM4AFP7D3RD53AEL7BKIOE4TBU.jpg)

More Stories

Latest interview with Jim Simmons, the hedge fund legend who donated his dividend money

Who is TAFE?: AGCO’s historical partner in India

How to contact Vodafone Collection