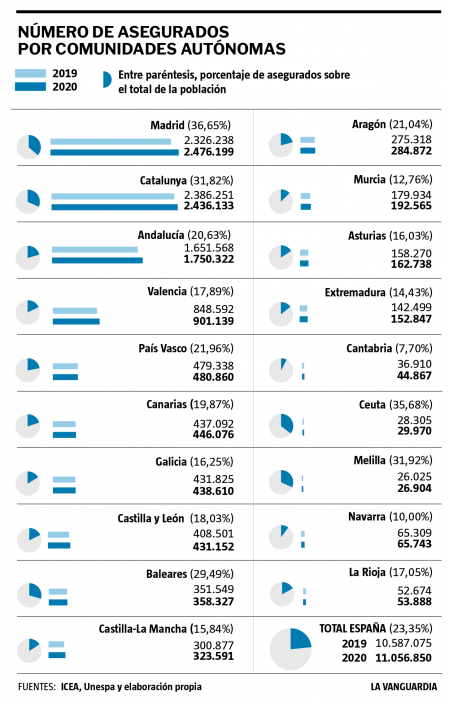

Today, in Spain, more than 11 million people have health insurance, which means that one in four people finance their medical care twice. And in regions such as Madrid, Barcelona, Ceuta or Melilla, more than a third of the population has private health insurance.

In 2020, despite the economic hardship caused by the pandemic, the number of insured people grew by 4.4%, the highest percentage in the past 10 years, according to data from the union of employers in the sector, Unespa. Specifically, an additional 470,000 people decided to take out insurance to facilitate access to private healthcare. And this year, through September, health insurance bills have already grown by 5% compared to last year and 10.3% compared to 2019.

In Catalonia, Madrid or the Balearic Islands, approximately one in three households has health insurance.

Health insurance, according to Unespa, “is present in 22% of Spanish households, and in communities such as Catalonia, Madrid and the Balearic Islands, the rate exceeds 30%”. But even in autonomous regions with less tradition of contracting medical insurance, such as Castilla-La Mancha or Extremadura, the number of insured has increased by 7.5%.

picture description

why? What is causing more and more people to pay for a policy to access private health care when they already pay with their taxes for public health care that offers universal coverage and advanced treatments?

Protests over under-resourced primary care, such as the one that occurred on the fourteenth in Santiago de Compostela, are increasingly frequent throughout Spanish geography.

“What is happening is that the public health system is in a very significant decline; during the pandemic, all the attention has been on Covid patients, but the population with non-Covid diseases is the majority and has seen their consultations with a specialist postponed or their diagnostic tests suspended, health centers closed and they experienced massive delays . sees a doctor, and only by phone, because it is still difficult to get a face-to-face consultation,” says Federation of Public Health Advocacy Associations, Dr. Marciano Sanchez Bale.

Data released last week supports his reasoning. In June, the average wait to see a specialist was two and a half months (75 days), with longer periods by specialty or independent society. In Catalonia, for example, it takes up to 149 days to visit a traumatologist, while the Spanish average is 87 days. For surgery, the average wait is 121 days, six days more than June 2019, but 49 days less than June 2020.

Read also

Added to this is the loss of diagnosis. According to a report by the UPF’s Center for Health Economics Research (CRES), in 2020 half the number of cancers detected in the previous year. In primary care, 30% of consultations for hypertension, 20% of consultations for diabetes, and half of consultations for obesity were not attended.

In fact, according to the 4th Egon Health and Lifestyles Study, a long wait for a medical appointment is one of the three reasons Spaniards cited for self-treatment.

Everything was focused on Covid patients, but the population with non-Covid diseases is the majority

Within this framework, “many people, if they can afford it, are looking for an alternative” in private health care, says Sanchez Bale, “because neither the central government nor the autonomous communities have responded by strengthening public health care, as they have repeatedly said in The worst moments of the pandemic and at the end of the first wave.”

picture description

To justify his argument, he noted that according to the government’s plan, only 1.5% of European funds will be allocated to alleviating the coronavirus crisis for health, while Portugal will allocate more than 8% and Italy 22%.

multifactorial phenomenon

The president of the Col legi de Metges in Barcelona, Jaume Padrós, believes that the health insurance boom is a multifactorial phenomenon, which is not only due to the epidemic, although this has had a significant impact due to the public’s saturation of health.

He also says that the increase in policyholders should also take place “with the concentration of companies and the price war between them, since they offer policies of questionable quality, with a lot of small print that are not worth, and at very low prices, thus attracting people who are looking for an alternative to the delays in public health, although some later feel cheated because they are not what they thought.”

price war

Because, as Padrus emphasizes, “policies are offered from 12 euros per month, so it is clear that the services are not for those who pay 100 or 150 euros per month, and many people feel cheated.”

This is confirmed by the Patient Advocate Association. “We get many complaints from people who, for example, pay for insurance for a long time and when they need an MRI they get charged separately, so they go to private healthcare running away from waiting lists and then have to come back to get tested And, above all, in public they say no, the system does not pay for what private doctors order or diagnose,” says Carmen Flores, president.

Too cheap and questionable quality policies are introduced, and then people feel robbed

However, they stress from the insurance sector that if the number of insured continues to grow – companies like Asisa have shown they were already doing so at an annual rate of 7% before the pandemic – it is because their product is attractive and well appreciated by users.

“Health insurance is a product that people use frequently, and patients and insurance company customers build trust relationships with doctors because they visit them periodically – with the same eye doctor or gynecologist at every yearly checkup. It conveys a very strong sense of service,” comments a Unespa spokesperson .

insurance

Caring for companies and employees

To ensure it’s well-rated, Jaime Ortiz, director of commercial and marketing at Asisa, points out that part of the increase in people with health insurance has to do with the fact that more and more companies, including small and medium businesses, are offering it as a flexible pay because it’s one of the most social benefits. appreciation among the employees.

“Health insurance guarantees very wide and differential coverage that, together with very short waiting times, makes it a product to attract and retain talent, as well as reduce absenteeism (employees can go directly to the specialist without having to lose another day to go to the family doctor, on the example), and it has tax advantages for companies that hire them,” says Ortiz.

Companies offer health insurance to attract and retain talent

Dr. Padrós agrees that the speed of access and the ability to choose a trusted specialist are two of the reasons many people pay for healthcare policy outside of private health.

“The easy thing to say is that public health lacks resources, but there is also a problem with management systems; it is necessary to modify primary care especially to provide distinguished professionals with organizational tools similar to those in other countries, so that they can self-regulate and manage intermediate product, tests and specialists, And thus respond better to the expectations of patients and create fewer waiting lists, says the president of Col Legi de Metges in Barcelona.

The keys to choosing a policy well

It is enough to enter one of the many online insurance comparators to find out that the range of health policies and rates that are offered for the same insured profile is very wide. For example, between 23 and 97 euros for a 31-year-old woman living in Barcelona; and between 42 and 126 for a 55-year-old man from the same county. Of course, the services they will receive depending on the policy they choose will not be the same, so it is worth comparing much more than the price before signing up for health insurance. And what do you look at? Experts answer: “In a thin line.”

This means analyzing the coverage and exclusions for each product, both public and private, because some insurances do not cover, for example, treatments related to diseases that a person already had before contracting the policy; or they set grace periods, i.e. terms of the policy are contracted out so that certain services can be accessed; or that they do not cover assistance if there are errors or missing information in health questionnaires prior to contracting out insurance; Or the exclusion of certain diagnostic or treatment techniques …

“When contracting insurance and analyzing the price, a person must be very clear about the use it will give it and choose the option that best suits his needs; for example, co-paid products if they will be used to a limited extent, or without co-payments if the use will be more frequent. Case in point Jaime Ortiz, Director of Commercial and Marketing at Asisa. It is also important to consider waiting times and medical staff to see which centers or professionals they will be able to access, as well as telemedicine options, he adds.

“Beeraholic. Friend of animals everywhere. Evil web scholar. Zombie maven.”

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/R5BNJX7RHGU5FSPXQJHMRLXVKE.jpg)

More Stories

“Without health there is nothing”

This will be the Europa Clipper probe

Why can tongue color indicate health problems according to science?